Featured

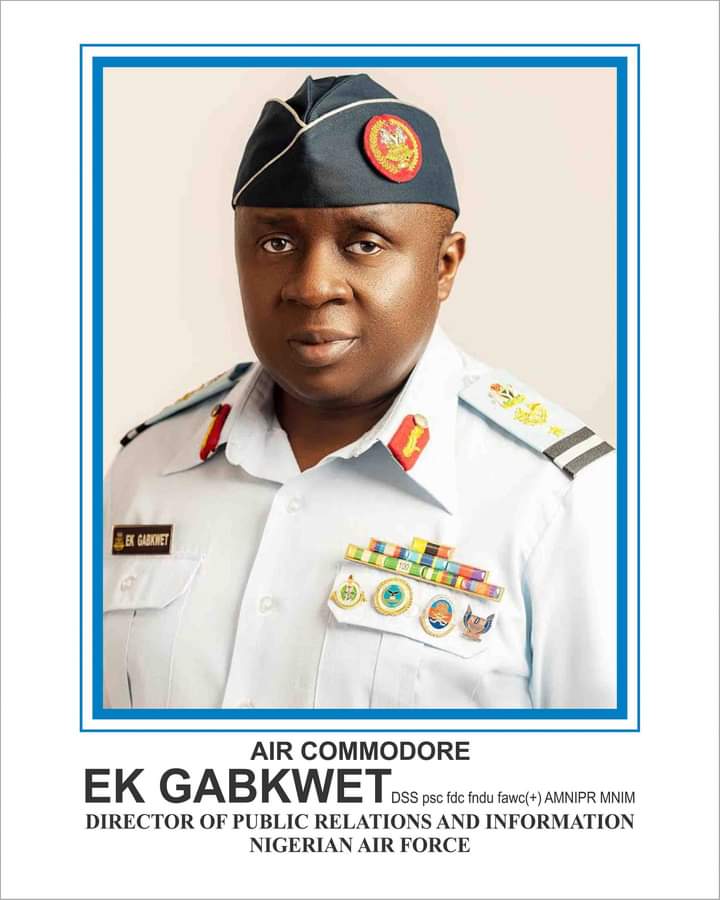

Air Commodore Edward Gabkwet Assumes Office As Director Of Public Relations And Information

Joel Ajayi

Following recent postings and deployments by the Nigerian Air Force (NAF), Air Commodore Edward Gabkwet has been appointed as the new Director of Public Relations and Information (DOPRI).

The new Spokesperson, Air Commodore Edward Gabkwet assumed office on 9th of March 2021 as the 17th DOPRI.

He took over from Air Vice Marshal Ibikunle Daramola who has been at the helm of affairs for about two years and seven months.

Air Commodore Edward Gabkwet Born in Kaduna hails from Pankshin Local Government Area of Plateau State. He attended St Joseph’s College, Vom, and Plateau State and later proceeded to the Nigerian Defence Academy as a member of 42nd Regular Course.

He was commissioned into the NAF as a Pilot Officer on 16 August 1996. He is an alumnus of the Nigerian Institute of Journalism, Ogba Lagos State, where he obtained a Post Graduate Diploma in Public Relations in 2008.

The senior officer has attended several courses some of which include, International Military Public Relations Course in Sweden, Junior and Senior Command and Staff Courses at the prestigious Armed Forces Command and Staff College, Jaji as well as Strategic Public Relations and Crisis Management Courses at Pinnacle PR, London. Additionally, he attended a Speech Writing Course organized by Ragan Communications at American University, Washington DC. Air Commodore Gabkwet is also an alumnus of the National Defence University, Champing, China, Air Force War College, Nigeria and the National Defence College, Nigeria.

The senior officer has held several appointments in the course of his military career. He was the Group Public Relations Officer at Air Weapon School (Now 407Air Combat Training Group), Kainji and at various times served as the Command Public Relations Officer at Tactical Air Command Makurdi, Training Command, (Now Air Training Command), Kaduna as well as Logistics Command, Lagos.

The new Spokesperson was also a United Nations Military Observer at the Democratic Republic of Congo between 2004 and 2005 where he also acted as the Assistant Military Spokesman. He served as the first Press Officer to the Chief of the Air Staff between 2010 – 2012. Other appointments held by the senior officer include the Deputy Defence Attaché (Air), Embassy of Nigeria, Beijing China between 2013 – 2016 and Command Training Officer at the Ground Training Command Enugu in 2018. Until his appointment, he was a member of Directing Staff and Director of Coordination at the Air Force War College, Makurdi. Air Commodore Edward Gabkwet is an Associate Member of the Nigerian Institute of Public Relations and a Member of the Nigerian Institute of Management.

The senior officer is decorated with the Distinguished Service Star, Fellow Defence College, Fellow National Defence University, Fellow Air War College (+) and the United Nations Medal among others. He is married to Mrs Patricia Jemcit Gabkwet and the union is blessed with 3 children. He enjoys playing golf and badminton as well as watching documentaries.

Featured

NELFUND: The Renewed Hope Engine Propelling Nigeria’s Youth into Tomorrow

By Dayo Israel, National Youth Leader, APC

As the National Youth Leader of the All Progressives Congress, I have spent most of my tenure fighting for a Nigeria where every young person, regardless of their ward or local government, family income, or circumstance, can chase dreams without the chains of financial despair.

Today, that fight feels like victory, thanks to the Nigerian Education Loan Fund (NELFUND). Launched as a cornerstone of President Bola Ahmed Tinubu’s Renewed Hope Agenda, this initiative isn’t just a policy tweak; it’s a revolution. And under the steady, visionary hand of Managing Director Akintunde Sawyerr, NELFUND has transformed from a bold promise into a roaring engine of opportunity, disbursing over ₦116 billion to more than 396,000 students and shattering barriers for over a million applicants.

Let’s be clear: NELFUND was always destined to be a game-changer. Signed into law by President Tinubu on April 3, 2024, it repealed the outdated 2023 Student Loan Act, replacing it with a modern, inclusive framework that covers tuition, upkeep allowances, and even vocational training—ensuring no Nigerian youth is left on the sidelines of progress.

But what elevates it from groundbreaking to generational? Leadership. Enter Akintunde Sawyerr, the diplomat-turned-executioner whose career reads like a blueprint for results-driven governance. From co-founding the Agricultural Fresh Produce Growers and Exporters Association of Nigeria (AFGEAN) in 2012—backed by icons like former President Olusegun Obasanjo and Dr. Akinwumi Adesina—to steering global logistics at DHL across 21 countries, Sawyerr brings a rare alchemy: strategic foresight fused with unyielding accountability.

As NELFUND’s pioneer MD, he’s turned a fledgling fund into a finely tuned machine, processing over 1 million applications since May 2024 and disbursing ₦116 billion—₦61.33 billion in institutional fees and ₦46.35 billion in upkeep—to students in 231 tertiary institutions nationwide. That’s not bureaucracy; that’s brilliance.

Sawyerr’s touch is everywhere in NELFUND’s ascent. Since the portal’s launch, he’s overseen a digital ecosystem that’s as transparent as it is efficient—seamless verification, BVN-linked tracking, and real-time dashboards that have quashed misinformation and built trust. In just 18 months, the fund has empowered 396,252 students with interest-free loans, many first-generation learners who might otherwise have dropped out.

Sensitization drives in places like Ekiti and Ogun have spiked applications — 12,000 in a single day in one instance, while expansions to vocational centers in Enugu pilot the next wave of skills-based funding. And amid challenges like data mismatches and fee hikes, Sawyerr’s team has iterated relentlessly: aligning disbursements with academic calendars, resuming backlogged upkeep payments for over 3,600 students, and even probing institutional compliance to safeguard every kobo. This isn’t management; it’s mastery—a man who doesn’t just lead but launches futures.

Yet, none of this happens in a vacuum. President Tinubu’s alliance with trailblazers like Sawyerr is the secret sauce securing Nigeria’s tomorrow. The President’s Renewed Hope Agenda isn’t rhetoric; it’s resources—₦100 billion seed capital channeled into a system that prioritizes equity over elitism. Together, they’ve forged a partnership where vision meets velocity: Tinubu’s bold repeal of barriers meets Sawyerr’s boots-on-the-ground execution, turning abstract policy into tangible triumphs. It’s a synergy that’s non-discriminatory by design—Christians, Muslims, every tribe and tongue united in access—fostering national cohesion through classrooms, not courtrooms.

As Sawyerr himself notes, this is “visionary leadership” in action, where the President’s political will ignites reforms that ripple across generations.

Why does this matter to us, Nigeria’s youth? Because NELFUND isn’t handing out handouts—it’s handing out horizons. In a country where 53% of us grapple with unemployment, these loans aren’t just funds; they’re fuel for innovation, entrepreneurship, and endurance.

Picture it: A first-generation polytechnic student in Maiduguri, once sidelined by fees, now graduates debt-free (repayments start two years post-NYSC, employer-deducted for ease) and launches a tech startup. Or a vocational trainee in Enugu, equipped with skills funding, revolutionizing local agriculture. This is quality education that endures—not fleeting certificates, but lifelong launchpads. Sawyerr’s focus on human-centered design ensures loans cover not just books, but bread—upkeep stipends of ₦20,000 monthly keeping hunger at bay so minds can soar. Under his watch, NELFUND has debunked doubts, refuted fraud claims, and delivered results that scream sustainability: Over ₦99.5 billion to 510,000 students by September, with 228 institutions on board.

As youth leaders, we see NELFUND for what it is: A covenant with our future. President Tinubu and MD Sawyerr aren’t just allies; they’re architects of an educated, empowered Nigeria—one where poverty’s grip loosens with every approved application, and innovation blooms from every funded desk. This isn’t charity; it’s an investment in the 70 million of us who will lead tomorrow.

We’ve crossed one million applications not because of luck, but leadership—a duo that’s turning “access denied” into “future unlocked.”

To President Tinubu: Thank you for daring to dream big and backing it with action.

To Akintunde Sawyerr: You’re the executor we needed, proving that one steady hand can steady a nation.

And to every Nigerian youth: Apply. Graduate. Conquer.

Because with NELFUND, your generation isn’t just surviving—it’s thriving, enduring, and eternal.

The Renewed Hope isn’t a slogan; it’s our story, now written in scholarships and success. Let’s keep turning the page.

Dayo Israel is the National Youth Leader of the All Progressives Congress (APC).

-

Featured6 years ago

Featured6 years agoLampard Names New Chelsea Manager

-

Featured6 years ago

Featured6 years agoFG To Extends Lockdown In FCT, Lagos Ogun states For 7days

-

Featured6 years ago

Featured6 years agoChildren Custody: Court Adjourns Mike Ezuruonye, Wife’s Case To April 7

-

Featured6 years ago

Featured6 years agoNYSC Dismisses Report Of DG’s Plan To Islamize Benue Orientation Camp

-

Featured4 years ago

Featured4 years agoTransfer Saga: How Mikel Obi Refused to compensate me After I Linked Him Worth $4m Deal In Kuwait SC – Okafor

-

Sports3 years ago

TINUBU LAMBAST DELE MOMODU

-

News11 months ago

News11 months agoZulu to Super Eagles B team, President Tinubu is happy with you

-

Featured6 years ago

Board urges FG to establish one-stop rehabilitation centres in 6 geopolitical zones