Business

FG To Attract Nigeria’s Foreign Saving With New Diaspora Bond

Joel Ajayi

As the World Bank-IMF Spring Meetings winds up, the Federal Government of Nigeria has stated that it plans to float a Diaspora Bond to attract funds held abroad by Nigerians at home and in the Diaspora.

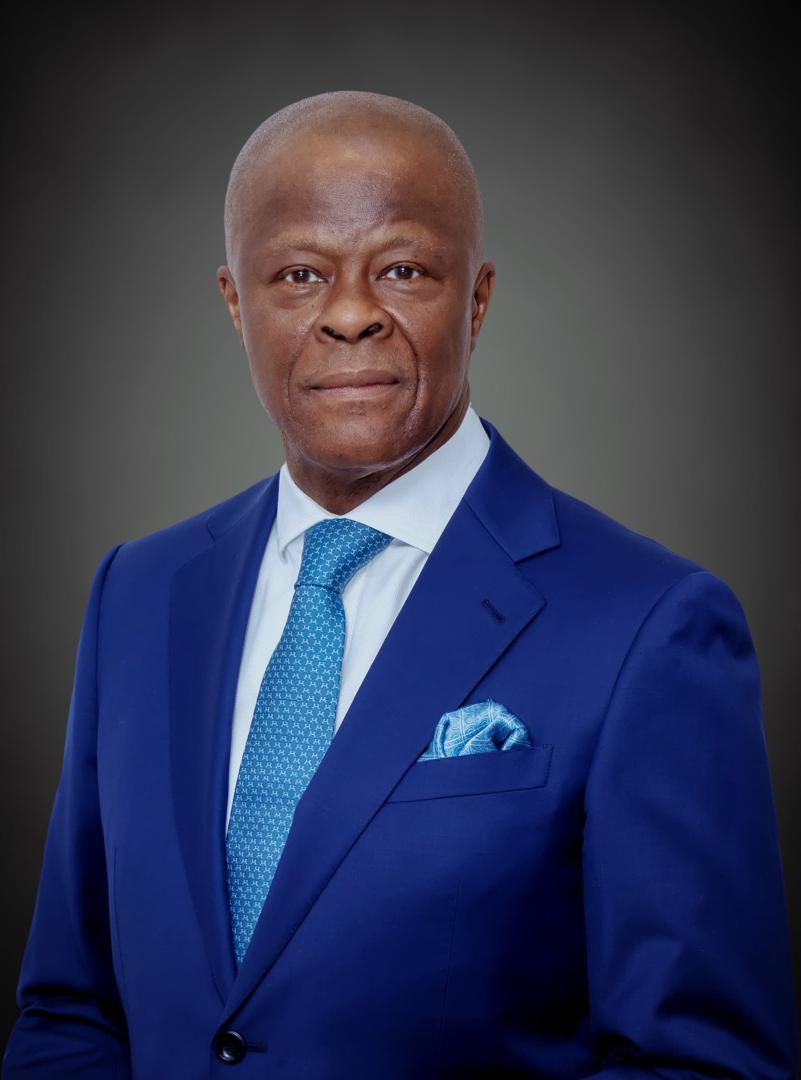

The Honourable Minister of Finance and Co-ordinating Minister of the Economy, Mr Wale Edun, disclosed this yesterday during his Wrap Up 2024 Spring Meetings’ media briefing held in Washington DC, United States of America.

He observed that remittances are certainly one of the ways the nation can increase the supply of foreign exchange and investment in the country.

The Minister informed that *there are Nigerians abroad who are doing very well. Even Nigerians in Nigeria with funds abroad that can be counted as remittance and in order to increase the supply of foreign exchange into the economy, government is looking at attracting those funds through a Diaspora kind of instrument, a Diaspora Bond we think, that will be attractive enough for Nigerians abroad and for foreign holdings of foreign currencies and look to having a substantial issue later in the year*, he said.

As part of the efforts of the administration to increase foreign exchange inflows, Mr. Edun informed further that Nigeria has qualified for the processing of a $2.25 billion World Bank facility.

*Nigeria has qualified for the processing of a total package of World Bank $2.25 billion, well there is no free money, but it is close to a grant for 40 years, moratorium of 10 years and about 1 percent interest. So that is also part of the flow that you can count*, the Minister said.

In addition, he explained that “there is a similar Budgetary Support, low-interest funding from the African Development Bank and clearly, there is also on-going discussions with Foreign Direct investors. Some of these things take longer than you expect, but there are relatively advanced discussions on major foreign direct investment inflows into the country, specific transactions with companies, institutions and authorities.

“The Minister said that the Spring Meetings presented an opportunity to engage the international audience on a global stage. *We have had the opportunity of speaking to international investors, portfolio investors and those International Direct investors that will bring what I will describe as quality funding. The kind of funding that builds factories and creates jobs”, he stated.

Mr. Edun noted that the response from all of them, *I can say, without exception, is that of greater confidence in the economic management of the country and greater interest and willingness to invest.”

“But in addition, not just the international community that we addressed, it is also critical that we are a private sector-driven economy and that is the policy of President Bola Ahmed Tinubu, to encourage private domestic and foreign investment to grow the economy, create jobs and reduce poverty**But also we have other partners – the multilateral organisations , development banks, bilateral financiers, grant-givers, foundations such as the Bill & Melinda Gates Foundation and others. The whole eco-system of international finance, we have engaged with all of them.”

“We have come away with funding to provide electricity to 300 million people in Africa that the largest portion will come to Nigeria. And you know what the provision of electricity does to increasing productivity and poverty reduction.

“We can also say that we have a bigger say for Africa through an additional Chair on the Board of Directors of the International Monetary Fund. I think it is a major success for Africa as a whole.” the Minister concluded.

While speaking on the sources of international funding to the Nigerian economy, he listed diaspora remittances, foreign portfolio investments, and facilities from the World bank as well as other international development partners.

Edun also tapped on issuing dollar-denominated securities specifically targeted at Nigerians in the diaspora and those with foreign-denominated savings in Nigeria as another measure to attract forex inflows into the country.

He disclosed that the Federal Government hopes to issue the bonds later this year and highlighted the efforts of the fiscal side of the economy in complimenting the recent monetary policy reforms by the Central Bank of Nigeria (CBN).

According to the Minister, *the issuing of government securities at an interest rate closer to the CBN’s monetary policy rate (MPR) is an indication of the collaboration between both sides of the economy in tackling inflation in the country and attracting forex inflows”.

He listed the agricultural sector as one area the President Bola Tinubu-led Administration is looking to spur growth in the medium term, noting that efforts in that area include the distribution of fertilisers and seeds to reduce food prices and enhance food security.

Other programs, according to the Minister, are: increasing power generation to about 6000 megawatts within six months, provision of infrastructure, especially housing with the goal of making low-interest mortgages available to Nigerians, revamping of the social investment program and proposed economic stabilisation plan.

The end of the 2024 World Bank-IMF Spring Meetings media briefing was attended by the Governor of the Central Bank of Nigeria (CBN), Mr Olayemi Cardoso, Permanent Secretary, Federal Ministry of Finance, Mrs Lydia Shehu Jafiya and other top government officials.

Business

TAJBank Emerges Nigeria’s Biggest Non-Interest Bank

Cyril Ogar

After five years of operations in Nigeria’s rapidly evolving non-interest banking (NIB) space, TAJBank Limited has become the biggest player in the NIB subsector based on its total assets and gross earnings values.

Disclosing this during his paper presentation on the key performance indices in the non-interest banking space over the past few years at a seminar organized by Leaders Corporate Services with the theme “Roles of Non-Interest Banks In SMEs’ Financing” for SME entrepreneurs yesterday in Abuja, an investment expert, Mr. Olabode Akeredolu-Ale, maintained that based on the non-interest banks’ approved financial statements for the half year 2025, TAJBank currently remained the biggest in terms of its total assets.

The expert, a chartered stockbroker, specifically confirmed that his recent investment researches on the NIBs and their financial performances showed that TAJBank, with its total assets rising to N1.017 trillion in half year 2025 up from N953.098 billion as of December 2024, which is about N53 billion higher than the nearest NIB’s assets, now ranked top in the banking subsector.

According to him, TAJBank’s gross earnings for H1 2025 also surged to N53.752 billion from N32.86 billion as of December 2024, representing a 64% growth, and higher than the nearest NIB’s gross earnings in the period under review.

This is even as he disclosed that on the NIBs’ earnings per share during the half year, TAJBank reported N61.36 kobo earnings per share, about 92% higher than the earnings per share of the next NIB during the period.

Akeredolu-Ale, who is also a chartered accountant, clarified: “The figures I am reeling out here on the NIBs are sourced from the banking and capital market regulatory institutions’ platforms, which anyone can access to verify.

“I am part of this event because of my research interest in non-interest banking and how the players in the subsector in Nigeria can help to leverage their competencies in innovation and ethical banking to support our MSMEs.

“Today, the MSMEs cannot access DMBs’ loans due to high lending rates and other inclement macroeconomic factors. This is where I think the NIBs have become very crucial to Nigeria’s economic growth.

“Overall, my findings on the NIBs indicated that they are all trying their best with non-interest loans to support entrepreneurs, particularly the MSMEs owners. I have advised those of them at this seminar to explore the cost-friendly financing options of the NIBs to grow their businesses by opening accounts with the NIBs”, the expert added.

Another speaker at the event, Benjamin Chukwudi, also commended the NIBs for their “catalytic roles in helping SMEs to access interest-free loans and providing them the needed financial management advisory, which have been helping them in sustaining their operations in the face of rising cost of doing business in the country.”

-

Featured6 years ago

Featured6 years agoLampard Names New Chelsea Manager

-

Featured6 years ago

Featured6 years agoFG To Extends Lockdown In FCT, Lagos Ogun states For 7days

-

Featured6 years ago

Featured6 years agoChildren Custody: Court Adjourns Mike Ezuruonye, Wife’s Case To April 7

-

Featured6 years ago

Featured6 years agoNYSC Dismisses Report Of DG’s Plan To Islamize Benue Orientation Camp

-

Featured4 years ago

Featured4 years agoTransfer Saga: How Mikel Obi Refused to compensate me After I Linked Him Worth $4m Deal In Kuwait SC – Okafor

-

Sports3 years ago

TINUBU LAMBAST DELE MOMODU

-

News10 months ago

News10 months agoZulu to Super Eagles B team, President Tinubu is happy with you

-

Featured6 years ago

Board urges FG to establish one-stop rehabilitation centres in 6 geopolitical zones