News

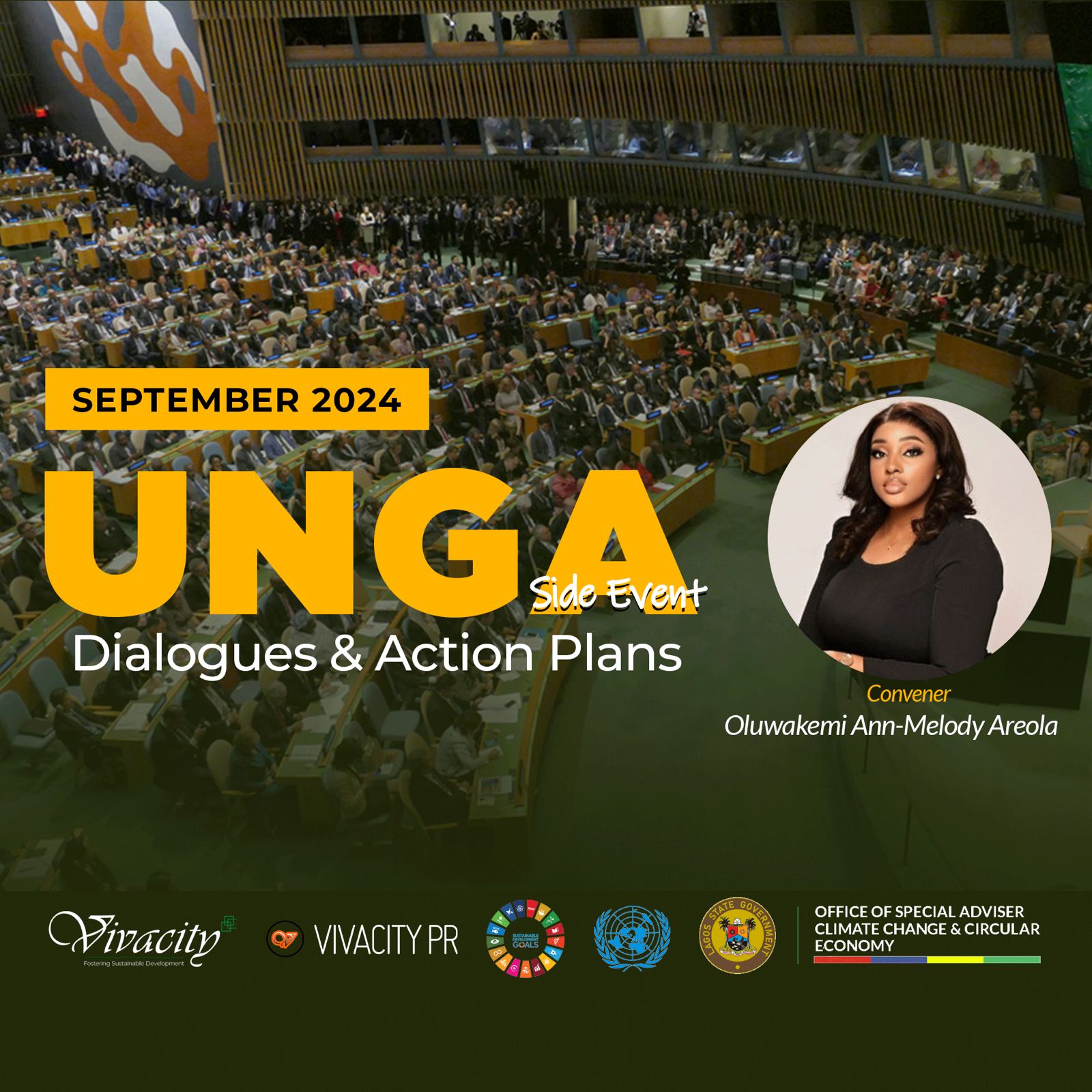

Vivacity Development Partners with OCCE to Host Side Event at UNGA 79

Engr. Oluwakemi Areola, CEO of Vivacity Development, has announced a timely side event set to take place at the United Nations General Assembly (UNGA) in New York later this year. She made this announcement during her speech at the GTA event held at the Landmark Centre in Lagos on July 20, 2024.

In her address, Engr. Areola stated the reasons behind the need for the side event titled “Forging the Future: Unveiling Innovative Solutions for Work, Sustainability, and the Green Economy.” She emphasized the urgency of upskilling Nigerians for future jobs, noting that by 2030, at least 30 million jobs will become obsolete. She highlighted the critical need for initiatives that prepare the workforce for emerging opportunities.

Vivacity Development’s previous participation in the United Nations Climate Change Conference (COP28) held from November 30 to December 12, 2023, in Expo City, Dubai, was a remarkable success. Partnering with Uganda Airlines, Vivacity Development successfully sent a delegation from Nigeria and hosted a highly impactful Side Event titled “Climate Change Awareness: Nigeria’s Action Plan.” The event drew significant attention from over 80,000 international stakeholders, providing a global platform for discussing Nigeria’s climate strategies. Building on this momentum, Vivacity has conducted workshops at various Nigerian universities, educating youth on sustainability and the future of work.

Engr. Areola also announced a strategic partnership with the Office of the Special Adviser on Climate Change & Circular Economy (OCCE), led by Titi Oshodi. This collaboration aims to leverage the competence of OCCE in its bid to continue to unlock the potential of the circular economy by converting waste into resources, thus creating jobs, optimizing government spending, and reducing carbon emissions.

Vivacity Development remains dedicated to fostering a better world. This upcoming event at UNGA 79 will initiate critical conversations on addressing pressing global challenges such as food security, climate change, and social injustice.

News

PSIN Administrator Commends Yobe Government for Championing Leadership Continuity and Institutional Sustainability

Cyril Igele

The Administrator and Chief Executive Officer of the Public Service Institute of Nigeria (PSIN), Barrister Imeh Okon, has applauded the Yobe State Government for its strong commitment to leadership continuity and sustainable governance through strategic investment in human capital development.

Barrister Okon gave the commendation at the opening of a Management Retreat for Yobe State Permanent Secretaries, held at the PSIN headquarters in Abuja.

The retreat, themed “Succession Planning, Leadership Continuity, and Institutional Sustainability in the Yobe State Public Service,” convened senior bureaucrats and resource persons to discuss strategies for strengthening leadership and governance within the state’s civil service.

In her remarks, the PSIN Administrator praised Governor Mai Mala Buni for his foresight and partnership in prioritizing public sector training and capacity development. She described the theme of the retreat as both “timely and visionary,” emphasizing that institutions endure only when leadership is continuous, knowledge is shared, and systems—not individuals—drive performance.

“Institutions thrive not merely on structures or policies, but on the deliberate cultivation of capable leaders who can sustain progress across generations,” she said. “By prioritizing leadership continuity and institutional resilience, Yobe State is leading by example.”

Barrister Okon reiterated PSIN’s mandate to build a competent, ethical, and innovative public service capable of delivering tangible results to citizens. She stressed that effective succession planning must be anchored in continuous training, mentorship, and exposure to emerging governance trends.

Citing best practices from Singapore and the United Kingdom, Okon noted that successful public service systems deliberately identify and nurture potential leaders through structured talent pipelines and transparent career development programmes. According to her, Yobe State’s initiative reflects its readiness to sustain excellence in governance.

She also highlighted PSIN’s flagship programmes—SMART-P, which builds administrative and technical capacity; LEAD-P, designed to groom emerging leaders; and the Exit from Service Masterclass, which prepares officers for life after service. Okon urged the Yobe Government to adopt the Exit Masterclass into its human resource framework to ensure a smooth transition for retirees, preserve institutional knowledge, and promote productivity through entrepreneurship and consultancy.

“Succession planning is not an event but a culture that must be institutionalised at every level of public administration,” she added. “When we prepare successors in advance and invest in continuous learning, we guarantee the sustainability of reforms and consistency in governance.”

Declaring the retreat open, the Acting Head of Service of Yobe State, Alhaji Abdullahi Shehu, reaffirmed Governor Buni’s commitment to building a results-driven and high-performing public service.

Represented by the Permanent Secretary, Public Service, Alhaji Shehu, the Acting Head of Service expressed gratitude to God and lauded PSIN as the “mother institution of public service learning.” He stated that Governor Buni has consistently directed the Office of the Head of Service to promote seamless succession planning and capacity building to enhance efficiency and accountability across government institutions.

“In line with this directive, we have brought the top echelon of the state civil service to PSIN—being the drivers and core implementers of government policies and programmes—to strengthen continuity and sustainability in our reforms,” he said.

He urged participants to fully engage in the retreat, share experiences, and cascade the knowledge gained to officers across ministries, departments, and agencies. The exercise, he explained, forms part of a deliberate strategy to institutionalize effective succession planning within the Yobe State Civil Service, thereby ensuring sustained productivity and improved service delivery to citizens.

-

Featured6 years ago

Featured6 years agoLampard Names New Chelsea Manager

-

Featured6 years ago

Featured6 years agoFG To Extends Lockdown In FCT, Lagos Ogun states For 7days

-

Featured6 years ago

Featured6 years agoChildren Custody: Court Adjourns Mike Ezuruonye, Wife’s Case To April 7

-

Featured6 years ago

Featured6 years agoNYSC Dismisses Report Of DG’s Plan To Islamize Benue Orientation Camp

-

Featured4 years ago

Featured4 years agoTransfer Saga: How Mikel Obi Refused to compensate me After I Linked Him Worth $4m Deal In Kuwait SC – Okafor

-

Sports3 years ago

TINUBU LAMBAST DELE MOMODU

-

News10 months ago

News10 months agoZulu to Super Eagles B team, President Tinubu is happy with you

-

Featured6 years ago

Board urges FG to establish one-stop rehabilitation centres in 6 geopolitical zones