Featured

Buhari approves recruitment of 5,000 personnel for NDLEA

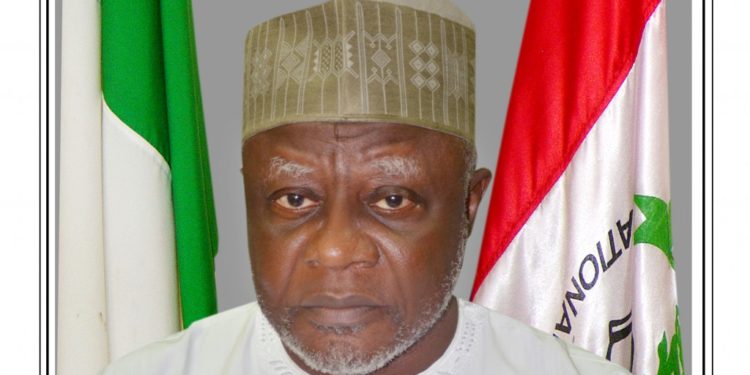

he Chairman, National Drug Law Enforcement Agency (NDLEA), Col. Muhammad Abdallah (retd), says President Muhammadu Buhari has approved recruitment of 5,000 personnel for the agency to boost its manpower.

Abdallah made the disclosure on Friday at the Public Destruction of Drug Exhibits by Taraba Command of NDLEA in Jalingo.

He said that the gesture would go a long way in improving operations of the agency on campaign against drug addiction in Nigeria.

He said increased consumption of illicit drugs among the youths in Taraba was worrisome, appealing to families to brace up to their responsibilities.

According to Abdallah, effective drug prevention must involve positive engagement of children, youths and adults with their families, schools, workplace and community.

He commended Gov. Darius Ishaku of Taraba for his support to the agency in addressing drug problems in the state.

He also commended Mrs Anna Darius, wife of the governor, for giving great impetus to the war against drug abuse in the state

The chairman thanked the governor for including NDLEA commandant in the state’s Security Council as well as supporting the agency with operational vehicles.

He noted that the provision of Hope Afresh Foundation, a Non-Governmental Organisation (NGO), managed by the wife of the governor for sensitisation against drug abuse was a great boost to anti-drug abuse campaign.

Earlier, Acting Commander of NDLEA in the state, Mr Peter Odaudu, had said that the agency had assembled seven tonnes (6,963.80 kilogrammes) of deadly weeds and psychotropic substances for destruction.

Odaudu said that the exhibits were seized between January, 2003 and December, 2018.

He listed some of the illicit drugs assembled for destruction as Cannabis Sativa, Diazepam, Rophynol, Cough syrups with codeine and Tramadol.

According to him, a court order for their destruction has been duly obtained.

Odaudu commended other security agencies in the state for their cooperation in the success recorded by the NDLEA.

He commended the state government for supporting the agency towards ensuring effective control in consumption of illicit drugs in the state.

In his remarks, the state governor, Mr Darius Ishaku, said that drug consumption had increased violent crimes in the state.

Ishaku, who was represented by the Deputy Governor, Alhaji Haruna Manu, said that most persons arrested for violent crimes in the state were youths.

He, therefore, urged the youths to avoid the use of illicit drugs, saying that it was dangerous to their health and the society.

He also urged the agency to collaborate with office of the First Lady to achieve more feat in its mandate of ensuring a drug-free society.

Ishaku said that the construction of health centres by the first lady’s foundation for sensitisation in the three senatorial zones was a better platform to adopt by the agency.

He assured the agency of continued support by the state government to eradicate drug abuse.

NAN

Featured

Daughters of Dr. Charles Ononiwu, Chiamanda and Chiamaka, Launch Debut Books to Uplift Hearts Facing Life’s Struggles

Joel Ajayi

At just 18 and 20 years old, Chiamanda and Chiamaka Ononiwu — daughters of renowned Nigerian surgeon Dr. Charles Ononiwu — have achieved a remarkable milestone with the release of their debut inspirational books, Do Not Be Afraid and Waterfalls.

Their literary journey began six years ago, during the height of the global COVID-19 pandemic. While the world was engulfed in fear and uncertainty, the then 13- and 15-year-old sisters turned inward, using writing as an outlet to process their emotions, express their faith, and reach out to others with messages of hope and resilience.

What began as a quiet act of creativity blossomed into two powerful books that now serve as beacons of light for readers navigating life’s storms.

Eighteen-year-old Chiamanda Ononiwu is the author of Do Not Be Afraid. A passionate Electrical Engineering student , she is also a proud alumna of Intellichild TLC and Valedictorian of Great Blessings School, Class of 2022.

In her book, she addresses the emotional challenges many young people face and draws from her personal faith to offer guidance and encouragement.

Her elder sister, Chiamaka Ononiwu, 20, is a final-year medical student at Babcock University in Nigeria. She penned Waterfalls, a heartfelt and deeply spiritual work she describes as divinely inspired. Chiamaka views her writing as a calling — a mission to uplift souls and bring hope to those struggling with life’s challenges.

“Personally, I would say it all started with the idea of inclusion, inspired by real human experiences,” Chiamaka shared. “We’ve had conversations with people who’ve gone through difficult situations — including issues and those stories helped shape what I write today.”

She added, “It’s all about encouraging people to face life with faith. We began this journey during a dark time in the world, and I felt called to create something that could offer comfort and hope — not just locally, but globally.”

The official book launch and signing ceremony took place on Wednesday in Abuja, Nigeria’s capital, and was attended by family, friends, colleagues, and well-wishers. It was a celebration of creativity, faith, and youthful brilliance, as the sisters presented their work to an inspired audience.

Speaking at the event, Chiamaka emphasized the core message of her book: “Waterfalls reminds readers that God is always watching over His people. He doesn’t bring fear — He brings peace, hope, and love. I want readers to find comfort and assurance in that truth.”

For Chiamanda, her book is a message to young people who may feel overwhelmed by life’s pressures: “Do Not Be Afraid is especially for youth navigating difficult times. No matter how hard life gets, you can always find strength and direction in God’s word.”

Writing came naturally to both sisters. Chiamaka recalled, “Even as a child, I loved writing short stories for my siblings. When the opportunity came to publish, I knew it was time to share my message with a wider audience.”

Despite their demanding academic paths, both young women balanced their studies with writing through perseverance and faith.

Chiamanda and Chiamaka are united by a shared dream — to inspire people across the world with their writing.

Chiamaka expressed Further; “Our biggest hope is that these books will reach people who need to know that God is real, that He’s always with them, and that through Him, anything is possible,” Chiamaka said.

With Do Not Be Afraid and Waterfalls, the Ononiwu sisters have not only created literary works — they’ve created lifelines. Their voices, grounded in faith and driven by purpose, remind readers everywhere that even in the darkest moments, God’s light never fades.

Their father, Dr. Charles Ononiwu — a distinguished surgeon and deeply devoted parent — also spoke at the event, sharing the journey from his perspective.

“For me, my number one priority has always been to care for children — not just medically, but also by encouraging them academically and in the basics of life,” he said.

He recounted a moving moment with Chiamanda, who approached him with the idea of sharing her story publicly to inspire others.

“She came to me and said she wanted to talk to her peers, to share how she had been comforted, and to help them see that everything would be okay,” he recalled. “As a father, my role was to guide her. I support both of them, help activate their strengths, and provide direction.”

Dr. Ononiwu made the decision to fund the publication of their books himself, believing in the power of their message.

“I told them, ‘You have something the world needs. You can make an impact in the lives of others,’” he said. “I believe every child has a gift. It is our responsibility as parents not to dismiss them, but to help them discover and nurture their talents.”

He encouraged all parents to support their children’s creative pursuits, noting, “Every person has something special inside them — no one is without talent. It’s just a matter of looking inward, discovering that gift, and sharing it with the world.”

-

Featured6 years ago

Featured6 years agoLampard Names New Chelsea Manager

-

Featured6 years ago

Featured6 years agoFG To Extends Lockdown In FCT, Lagos Ogun states For 7days

-

Featured6 years ago

Featured6 years agoChildren Custody: Court Adjourns Mike Ezuruonye, Wife’s Case To April 7

-

Featured6 years ago

Featured6 years agoNYSC Dismisses Report Of DG’s Plan To Islamize Benue Orientation Camp

-

Featured4 years ago

Featured4 years agoTransfer Saga: How Mikel Obi Refused to compensate me After I Linked Him Worth $4m Deal In Kuwait SC – Okafor

-

Sports3 years ago

TINUBU LAMBAST DELE MOMODU

-

News10 months ago

News10 months agoZulu to Super Eagles B team, President Tinubu is happy with you

-

Featured6 years ago

Board urges FG to establish one-stop rehabilitation centres in 6 geopolitical zones

2 Comments