Featured

China’s poor rural population lifted out of poverty under current standards, Xi says

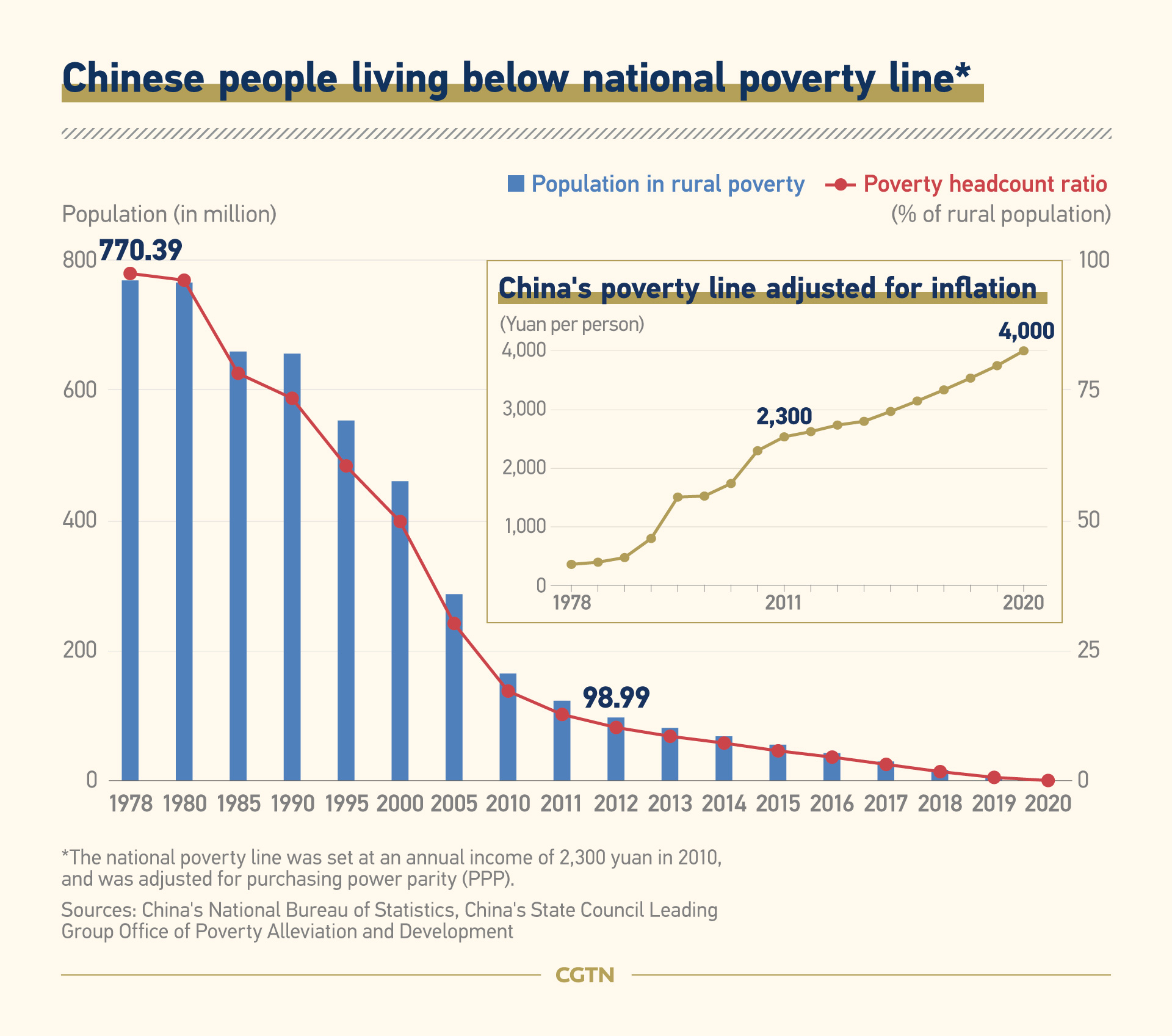

All of China’s impoverished rural population has been lifted out of poverty under current standards, announced Chinese Presiden’’/

t Xi Jinping on Monday, after the last nine poverty-stricken counties in the southwestern province of Guizhou declared victory over poverty.

Following President Xi’s anti-poverty drive, the Chinese leadership set 2020 as the deadline to eradicate absolute poverty in the country, defined as living on an annual income below 4,000 yuan, or roughly $611.40

About 100 million poor people have shaken off poverty during eight years of sustained work, Xi said in his congratulatory letter to a global forum that shares poverty alleviation experience.

“The Communist Party of China (CPC) and the Chinese government have always been devoted to the cause of letting the people lead a good life,” stressed Xi, who also serves as general secretary of the CPC Central Committee.

Xi:Battle against poverty a global challenge

Yet, at a time when the COVID-19 pandemic still soars across the world, the battle against poverty remains a tough challenge, as Xi pointed out. “China is willing to work with other countries in the process of reducing poverty and to push for the building of a community with a shared future for mankind,” he said in the message.

According to data from the World Bank, China has lifted more than 850 million people from extreme poverty after the country’s economic reformation in 1978. Since 2013, an average of over 10 million people were lifted from deprivation after taking the approach of “targeted poverty alleviation,” which essentially means taking on tailored relief measures to fit different local conditions.

“Every poor household, tens of millions, has its own dossier, listing every member; it is updated monthly, and information is sent to Beijing regularly,” wrote Robert Lawrence Kuhn in a CGTN opinion piece, after spending weeks in some of China’s poorest regions. And that has surprised this international corporate strategist and recipient of the China Reform Friendship Medal (2018).

Yet China’s strive in eradicating poverty has not been limited to the homeland.

In a recent meeting to honor the 75th anniversary of the United Nations (UN), Xi announced China’s new measures to augment the efforts of the UN in alleviating all forms of poverty. With more than 700 million people living in extreme poverty, representing 10 percent of the world’s population, eliminating poverty by 2030 tops the UN’s 17 Sustainable Development Goals (SDG).

“In spite of the fact that the dynamics for poverty may differ from one country to the other, there are many lessons that can be drawn from the effective economic measures China has implemented in reducing poverty,” commented chartered economist Alexander Ayertey Odonkor.

“Developing countries can take a cue from China’s level of infrastructure development in urban and rural areas by addressing challenges associated with electrification, road networks, housing, water, and sanitation. Adopting a development-oriented approach in mitigating poverty has proven to be an indispensable tool,” he said.

Featured

Daughters of Dr. Charles Ononiwu, Chiamanda and Chiamaka, Launch Debut Books to Uplift Hearts Facing Life’s Struggles

Joel Ajayi

At just 18 and 20 years old, Chiamanda and Chiamaka Ononiwu — daughters of renowned Nigerian surgeon Dr. Charles Ononiwu — have achieved a remarkable milestone with the release of their debut inspirational books, Do Not Be Afraid and Waterfalls.

Their literary journey began six years ago, during the height of the global COVID-19 pandemic. While the world was engulfed in fear and uncertainty, the then 13- and 15-year-old sisters turned inward, using writing as an outlet to process their emotions, express their faith, and reach out to others with messages of hope and resilience.

What began as a quiet act of creativity blossomed into two powerful books that now serve as beacons of light for readers navigating life’s storms.

Eighteen-year-old Chiamanda Ononiwu is the author of Do Not Be Afraid. A passionate Electrical Engineering student , she is also a proud alumna of Intellichild TLC and Valedictorian of Great Blessings School, Class of 2022.

In her book, she addresses the emotional challenges many young people face and draws from her personal faith to offer guidance and encouragement.

Her elder sister, Chiamaka Ononiwu, 20, is a final-year medical student at Babcock University in Nigeria. She penned Waterfalls, a heartfelt and deeply spiritual work she describes as divinely inspired. Chiamaka views her writing as a calling — a mission to uplift souls and bring hope to those struggling with life’s challenges.

“Personally, I would say it all started with the idea of inclusion, inspired by real human experiences,” Chiamaka shared. “We’ve had conversations with people who’ve gone through difficult situations — including issues and those stories helped shape what I write today.”

She added, “It’s all about encouraging people to face life with faith. We began this journey during a dark time in the world, and I felt called to create something that could offer comfort and hope — not just locally, but globally.”

The official book launch and signing ceremony took place on Wednesday in Abuja, Nigeria’s capital, and was attended by family, friends, colleagues, and well-wishers. It was a celebration of creativity, faith, and youthful brilliance, as the sisters presented their work to an inspired audience.

Speaking at the event, Chiamaka emphasized the core message of her book: “Waterfalls reminds readers that God is always watching over His people. He doesn’t bring fear — He brings peace, hope, and love. I want readers to find comfort and assurance in that truth.”

For Chiamanda, her book is a message to young people who may feel overwhelmed by life’s pressures: “Do Not Be Afraid is especially for youth navigating difficult times. No matter how hard life gets, you can always find strength and direction in God’s word.”

Writing came naturally to both sisters. Chiamaka recalled, “Even as a child, I loved writing short stories for my siblings. When the opportunity came to publish, I knew it was time to share my message with a wider audience.”

Despite their demanding academic paths, both young women balanced their studies with writing through perseverance and faith.

Chiamanda and Chiamaka are united by a shared dream — to inspire people across the world with their writing.

Chiamaka expressed Further; “Our biggest hope is that these books will reach people who need to know that God is real, that He’s always with them, and that through Him, anything is possible,” Chiamaka said.

With Do Not Be Afraid and Waterfalls, the Ononiwu sisters have not only created literary works — they’ve created lifelines. Their voices, grounded in faith and driven by purpose, remind readers everywhere that even in the darkest moments, God’s light never fades.

Their father, Dr. Charles Ononiwu — a distinguished surgeon and deeply devoted parent — also spoke at the event, sharing the journey from his perspective.

“For me, my number one priority has always been to care for children — not just medically, but also by encouraging them academically and in the basics of life,” he said.

He recounted a moving moment with Chiamanda, who approached him with the idea of sharing her story publicly to inspire others.

“She came to me and said she wanted to talk to her peers, to share how she had been comforted, and to help them see that everything would be okay,” he recalled. “As a father, my role was to guide her. I support both of them, help activate their strengths, and provide direction.”

Dr. Ononiwu made the decision to fund the publication of their books himself, believing in the power of their message.

“I told them, ‘You have something the world needs. You can make an impact in the lives of others,’” he said. “I believe every child has a gift. It is our responsibility as parents not to dismiss them, but to help them discover and nurture their talents.”

He encouraged all parents to support their children’s creative pursuits, noting, “Every person has something special inside them — no one is without talent. It’s just a matter of looking inward, discovering that gift, and sharing it with the world.”

-

Featured6 years ago

Featured6 years agoLampard Names New Chelsea Manager

-

Featured6 years ago

Featured6 years agoFG To Extends Lockdown In FCT, Lagos Ogun states For 7days

-

Featured6 years ago

Featured6 years agoChildren Custody: Court Adjourns Mike Ezuruonye, Wife’s Case To April 7

-

Featured6 years ago

Featured6 years agoNYSC Dismisses Report Of DG’s Plan To Islamize Benue Orientation Camp

-

Featured4 years ago

Featured4 years agoTransfer Saga: How Mikel Obi Refused to compensate me After I Linked Him Worth $4m Deal In Kuwait SC – Okafor

-

Sports3 years ago

TINUBU LAMBAST DELE MOMODU

-

News10 months ago

News10 months agoZulu to Super Eagles B team, President Tinubu is happy with you

-

Featured6 years ago

Board urges FG to establish one-stop rehabilitation centres in 6 geopolitical zones