Business

Nigeria Headline Inflation Drops, Production Costs Remain High-NBS

The National Bureau of Statics, NBS has disclosed that Nigeria’s headline inflation fell from 21.47 per cent in November 2022 to 21.34 per cent in December 2022.

It could be recalled that in 2022, the country’s inflation rate rose from January to November, before falling by 0.13 per cent to 21.34 per cent in December.

The NBS explained that while headline inflation fell year-on-year, it increased from 1.39 per cent in November 2022 to 1.71 per cent in December 2023.

The statistics body consistently blamed the nation’s woe with inflation in 2022 on the rising cost of importation, currency depreciation, increases in the cost of production, and a foreign exchange crisis.

Commenting on the increase in month-on-month inflation, it said, “Basically, the likely factors responsible for increase in inflation rate in month-on-month can be attributed to the sharp increase in demand usually experienced during the festive season, increase in the cost of production e.g. increase in energy cost, transportation cost, exchange rate depreciation etc.”

Headline inflation in Nigeria rose from 15.60 per cent in January 2022 to 21.34 per cent in December 2022. In its ‘Consumer Price Index (December 2022),’ the NBS said, “In December 2022, the headline inflation rate eased to 21.34 per cent compared to November 2022 headline inflation rate which was 21.47 per cent.

“Looking at the trend, December 2022 inflation rate showed a decline of 0.13 per cent when compared to November 2022 inflation rate. However, on a year-on-year basis, the headline inflation rate was 5.72 per cent points higher compared to the rate recorded in December 2021, which was (15.63 per cent).

“This shows that the headline inflation rate increased in the month of December 2022 when compared to the same month in the preceding year (i.e., December 2021). On a month-on-month basis, the percentage change in the All Items Index in December 2022 was 1.71 per cent, which was 0.32 per cent higher than the rate recorded in November 2022 (1.39 per cent).

“This means that in the month of December 2022, the general price level was 0.32 per cent higher relative to November 2022. The percentage change in the average CPI for the twelve months ending December 2022 over the average of the CPI for the previous twelve months period was 18.85 per cent, showing 1.89 per cent increase compared to the 16.95 per cent recorded in December 2021.”

According to the NBS, food inflation rose to 23.75 per cent year-on-year in December 2022, 6.38 per cent higher than the rate recorded in December 2021 (17.37 per cent).

It explained that the rise in food inflation was driven by increases in prices of bread and cereals, oil and fat, pota-toes, yam and other tubers, fish, and food product. Inflation was highest in Bauchi (23.79 per cent), Kogi (23.35 per cent), Anambra (23.13 per cent), and lowest in Taraba (18.98 per cent), Osun (19.09 per cent), and Kwara (19.18 per cent).

Business

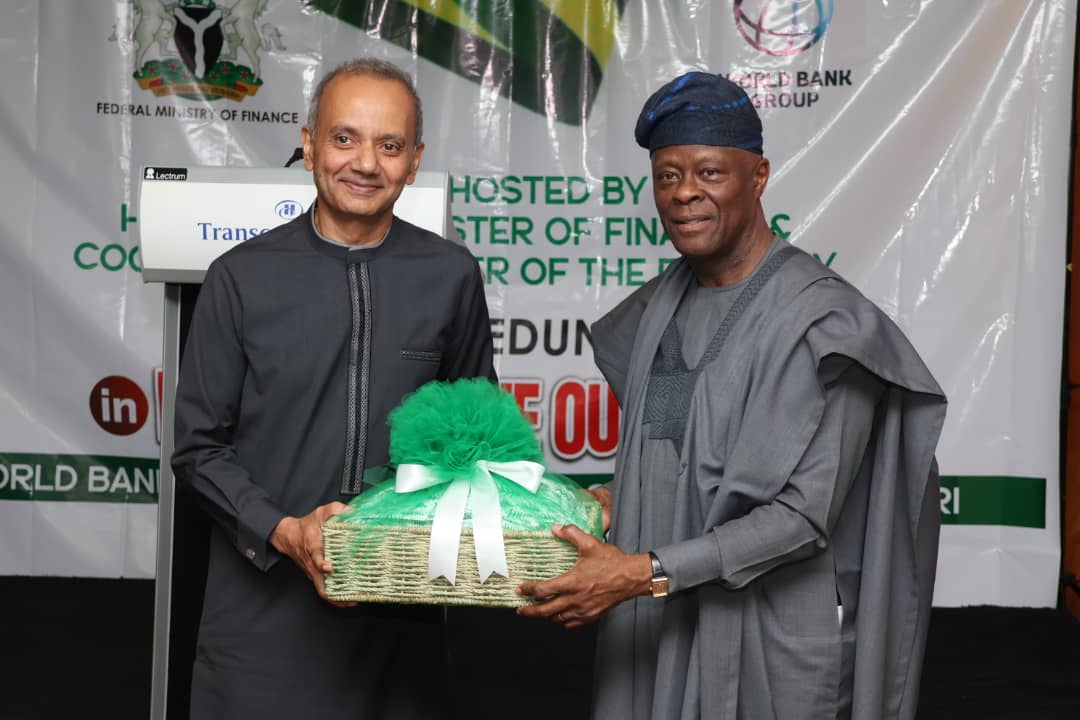

Edun Commends Outgoing World Bank County Director Dr Chaudhary, Lauds Organization’s impact On Nigeria’s Economy

Joel Ajayi no

The Honourable Minister of Finance and Co-ordinating Minister of the Economy, Mr Wale Edun, has commended the outgoing World Bank Country Director, Dr. Shubham Chaudhari for his Significant Contributions to Nigeria’s Economic Growth.

At an event held in Abuja, hosted by the Honourable Minister in honour of the out-going World Bank Country Director, Mr Edun acknowledged the Organization’s crucial role in promoting socio-economic sustainability and enhancing Nigeria’s economic competitiveness.

He expressed appreciation for the remarkable achievements recorded during Dr. Chaudhari’s tenure and reaffirmed the country’s commitment to building on these accomplishments so as to further drive economic progress in line with the Renewed Hope Agenda of the President Bola Ahmed Tinubu-led Administration.

*We appreciate your tireless efforts towards the promotion of economic growth and development in Nigeria. Your leadership and expertise have made a significant impact on our country’s progress. Your dedication to supporting Nigeria’s development agenda is truly commendable.

“We are grateful for these contributions and look forward to continued collaboration. Your commitment to fostering inclusive and sustainable growth in Nigeria is inspiring. We appreciate your partnership and guidance in shaping our country’s future*, Edun said.

He informed that the hallmark of the present administration’s policy thrust that brought fiscal reforms was aimed at boosting the nation’s economic development with a view to attracting foreign investments so as to ensure job creation, poverty reduction and improved standard of living for the citizenry.

The Minister assured that Nigeria offers a wealth of opportunities for foreign investors, with a large and growing market, rich natural resources, and a skilled workforce. *We invite you to explore the possibilities and partner with us for mutual growth. Join us in harnessing the potential of Nigeria’s emerging economy. Our country offers a favourable business environment, investment incentives, and a dynamic market waiting to be tapped.

Mr Wale Edun invited the international community to discover the opportunities and advantages of investing in Nigeria.

“Our government is committed to creating a conducive environment for businesses to thrive and succeed. We are inviting the international development partners to come to Nigeria and invest their resources. Nigeria is a country with diverse business opportunities and market potentials for profit maximisation”, he stressed.

The Minister stated further that Nigeria would continue to be a development partner with the World Bank, and that the present administration was committed to championing a good cause as well as implement policies that would boost the country’s economy in order to make it more vibrant and resilient.

Edun further appreciated Dr Chaudhari’s tenure, which he said, underscores the importance of supporting and recognizing Nigeria, aligning with President Bola Ahmed Tinubu’s pragmatic leadership in providing good governance.

He added that the reforms initiated by the administration would serve as a window to the global investment community, stressing that Nigeria is open for business with stable and profitable benefits thereby calling on Philanthropists, both within and outside the country, to invest their resources in Nigeria, a country which he said, has the largest population in Africa.

Edun explained that *the disputable access to renewal energy recently launched was an indication to build trust, attract foreign investment, and foster international partnerships aimed at reinvigorating the Nigerian economy.”

Speaking during the event, Dr. Shaubham Chaudhari, the out-going World Bank Country Director, described the event as symbolic and strategic, saying that it would help build bonds in relationship trust. He commended Nigeria for its proactive measures and robust efforts in bracing up monetary policies and in fostering sustainable economic development despite the daunting challenges.

The out-going Director assured that his Organisation’s doors were widely open for more collaborations and partnerships for the country’s growth.

Earlier in her remarks at the event, the Permanent Secretary, Federal Ministry of Finance, Mrs Lydia Shehu Jafiya assured that the Ministry will continue to provide an enabling environment for the full implementation of the policies, programmes and projects of the Federal Government in line with its mandate.

She appealed to the international community to support the efforts of the present administration in its determination to boost the country’s economy and further stressed the need for international partners to take advantage of the country’s diversity and invest their resources for maximum benefits.

*Nigeria offers a vast and untapped market, rich in natural resources and human capital. We invite you to explore the numerous investment opportunities and be a part of our growth story. Join us in shaping Nigeria’s future and tapping into the immense potentials of our economy. Together, let’s create a prosperous and sustainable tomorrow.**Nigeria is open for business. We welcome foreign investors to partner with us in unlocking our economic potentials and driving growth in key sectors.” Jafiya said.

Also speaking, the Permanent Secretary Special Duties, Mr Okokon Ekanem Udo, assured that the present administration was committed to putting and implementing projects that will impact on the lives of Nigerians in line with contemporary global realities.

He commended the outgoing World Bank Country Director, Dr. Shaubham Chaudhari for his commitment and dedication.

Thank you for your dedication and commitment. We are grateful for your unwavering support and guidance, which has helped us navigate complex development challenges and create a brighter future for Nigerians.* Udo said.

-

Featured5 years ago

Featured5 years agoLampard Names New Chelsea Manager

-

Featured4 years ago

Featured4 years agoFG To Extends Lockdown In FCT, Lagos Ogun states For 7days

-

Featured5 years ago

Featured5 years agoNYSC Dismisses Report Of DG’s Plan To Islamize Benue Orientation Camp

-

Featured4 years ago

Featured4 years agoChildren Custody: Court Adjourns Mike Ezuruonye, Wife’s Case To April 7

-

Featured3 years ago

Featured3 years agoTransfer Saga: How Mikel Obi Refused to compensate me After I Linked Him Worth $4m Deal In Kuwait SC – Okafor

-

Sports2 years ago

TINUBU LAMBAST DELE MOMODU

-

News9 months ago

News9 months agoJubilation In Kaduna As Tribunal Upholds Ekene Adam Winner Of Reps Election

-

Featured5 years ago

Board urges FG to establish one-stop rehabilitation centres in 6 geopolitical zones