Business

Nigeria Poised for Industrial Breakthrough Driven by Innovation and Indigenous Technologies – RMRDC DG

By Joel Ajayi

Nigeria is on the cusp of a major industrial transformation, powered by innovation, indigenous technology, and the ingenuity of its people, says Professor Nnanyelugo Martin Ike-Muonso, Director-General of the Raw Materials Research and Development Council (RMRDC).

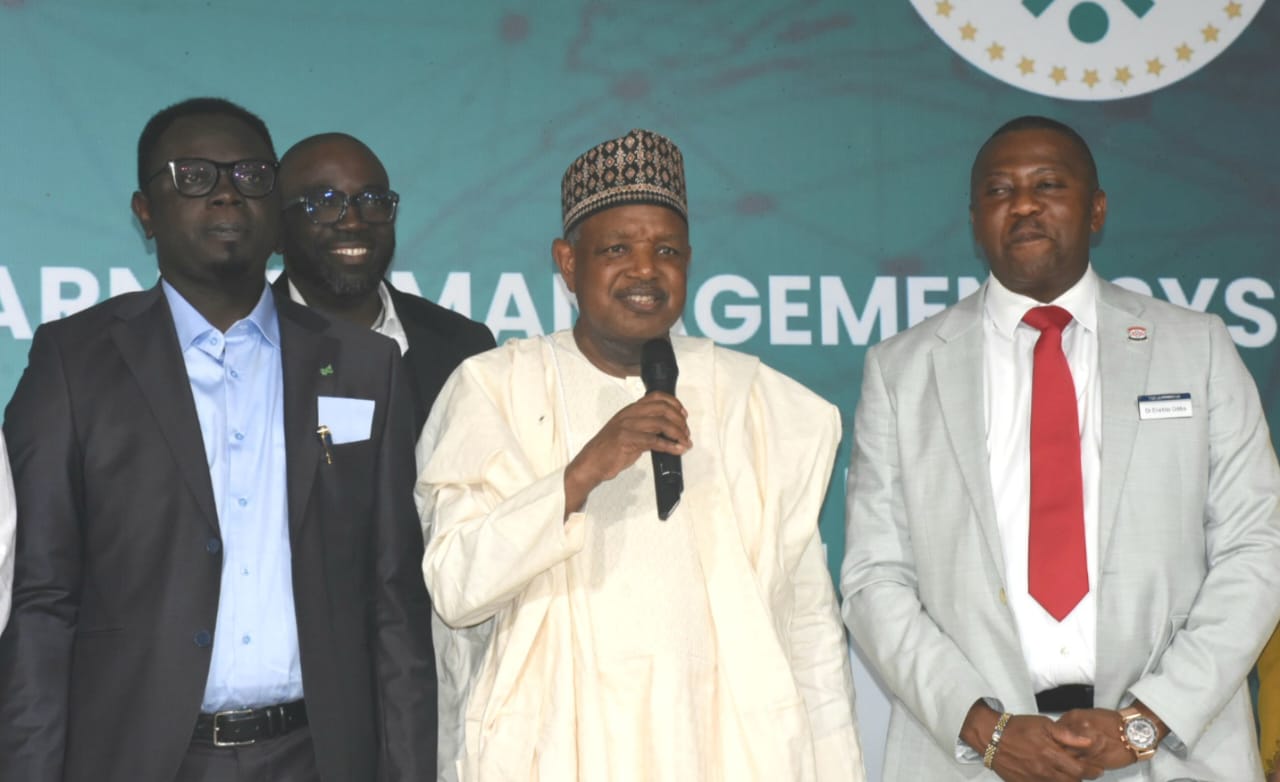

Speaking at the Investors Forum on Commercialisation of Indigenous Technologies held at the Council’s Research and Demonstration Plant Complex (RDPC) in Abuja, Prof. Ike-Muonso said the nation’s industrial future looks promising—thanks to years of research and development now ready for commercial adoption.

“Fifty years ago, the vision of an industrialised Nigeria seemed distant, hampered by resource dependency and an underdeveloped manufacturing sector. But today, I see a Nigeria on the brink of a new era—one anchored on the innovation and resourcefulness of our people,” he stated.

The DG noted that RMRDC has remained committed to its mandate of harnessing Nigeria’s vast raw material base to drive sustainable industrial growth. According to him, the Council has invested extensively in research, development, and technology demonstration to shift Nigeria from an exporter of raw materials to a producer of value-added goods.

He revealed that several indigenous technologies are now ready for commercial scale-up, including: Castor Oil Processing, Plaster of Paris (POP), Artemisia annua Extraction, Soap Noodles Productionand Caustic Soda (Sodium Hydroxide)

“This forum is more than just an exhibition of successful pilot projects,” Prof. Ike-Muonso said. “It is a call to action. We invite industrialists and investors to engage with our experts, witness live demonstrations, and evaluate the strong investment potential of these technologies. We are open to private sector collaborations, technical partnerships, and joint ventures to scale these innovations both nationally and globally.”

He also emphasized the potential impact of the 30% Value Addition Bill, which has passed the Senate and awaits concurrence in the House of Representatives. The legislation, once enacted, is expected to significantly boost local content and value addition across Nigeria’s raw materials ecosystem.

Earlier, Mr. Adamu Yaro Mohammed, Director of the Investment Promotion and Consultancy Services Department and head of RDPC, highlighted the Centre’s strategic role in advancing Nigeria’s industrialisation. He urged participants to explore the commercial and technical viability of the showcased technologies.

The event featured technical presentations, including one by Dr. Mohammed Lawal Buga titled “Commercialisation of Research and Development Outputs.” He emphasized that while research is a tool for discovery and problem-solving, commercialisation is the bridge linking innovation to industry—enabled by the “Triple Helix” model, which connects academia, government, and the private sector.

Another presentation, “Unlocking Wealth from Within: Commercialising Indigenous Technologies for Raw Materials Processing in Nigeria,” by Dr. Obekpa, underscored the untapped potential within Nigeria’s research and development ecosystem.

He showcased innovations from key institutions, including:

RMRDC: Acha processing machines, bamboo pulp line, ceramic kiln

FIIRO: Bread improver, cassava flash dryer, soy milk production system

NASENI: Solar inverters, agricultural sprayers, foundry technology

PRODA: Gas cookers, ceramic tiles, industrial dryers

NCAM: Palm oil expellers, rice threshers

Dr. Obekpa also acknowledged the policy and funding challenges hindering commercialisation and called for stronger institutional support.

Several stakeholders in attendance—including representatives from NACCIMA, NEXIM Bank, NEPC, and MSMEs—commended RMRDC’s progress and advocated broader media engagement to raise public awareness.

In his remarks, Mr. Chukwuma Ngaha, Director of Corporate Affairs, praised the DG’s leadership, noting that RMRDC has initiated strategic programmes aimed at reshaping Nigeria’s raw material value chains.

The forum concluded with a guided tour of the RDPC facilities. Participants expressed admiration for the scale, sophistication, and innovation on display, and called for increased national attention and investment in the Council’s initiatives.

While giving votes of thanks Deputy Director of RDPC, Mr. Muktar, appreciated all participants for their support and active engagement.

Business

FG, Investonaire Academy Unveil National Programme to Equip 100,000 Youths with Financial Skills, Digital Wealth Tools

By Joel Ajayi

The Federal Government, in collaboration with Investonaire Academy, has unveiled a nationwide financial literacy and wealth-building programme targeting more than 100,000 young Nigerians. The initiative is designed to equip participants with practical skills in budgeting, saving, investing, asset building, and long-term financial planning, positioning them for sustainable prosperity in a rapidly evolving economy.

Launched on Tuesday in Abuja, the Honourable Minister of Youth Development, Comrade Ayodele Olawande, described financial literacy as a necessary survival tool for young people confronting today’s economic realities.

He noted that the initiative represents the foundation of a broader vision expected to extend beyond Nigeria to other African nations and global markets.

Reaffirming the Federal Government’s commitment to supporting over 4,000 corps members annually, the Minister said the programme will provide platforms, resources, and skills needed for both job creation and employability.

“The young people who understand money — how to save, invest, build assets, and manage risk — are the ones who will lead Nigeria into prosperity,” he said.

A major highlight of the launch was the expansion of the Nigeria Youth Academy, a digital platform offering mentorship, training, and startup support. According to the Minister, more than 200 startups will receive empowerment through the Academy’s e-app platform before the end of the year.

He stressed the need for deeper collaboration with private organisations, innovators, and youth-focused groups, noting that government alone cannot drive youth development. He further encouraged young Nigerians to embrace skills acquisition, innovation, and digital enterprise, saying these remain critical to reducing the desire for migration and increasing self-reliance.

Outlining the Ministry’s long-term commitments, Olawande emphasized three priorities: supporting youth innovation, equipping them with growth tools, and safeguarding millions of Nigerian youths under the Ministry’s mandate.

Speaking at the launch, Sebastien Sicre, Chief Operating Officer of Investonaire Academy, said the programme was crafted to revolutionize the way Nigerian youths learn and apply financial knowledge. He highlighted the Academy’s gamified Learning Management System (LMS), which offers interactive learning tools, community forums, and real-time mentorship to make financial education engaging and accessible.

Complementing the digital platform is a new 200-square-metre physical training centre in Abuja, opposite the NNPC Towers, where in-person workshops and mentorship sessions will take place.

The curriculum covers key global asset classes — including equities, commodities, forex, and indices — ensuring participants gain a broad understanding of financial markets.

Sicre added that with Federal Government backing, the programme seeks to unlock new opportunities, strengthen youth participation in the digital economy, and reward outstanding participants through a $1 million funding pool to support new and existing ventures.

International Programme Director of Investonaire Academy, Dr. Enefola Odiba, explained that the initiative aims to bridge long-standing gaps in financial education among Nigerian youths. While schools teach many subjects, he said, essential financial skills are often missing.

“Many people can earn money — earning money can be easy. The real challenge is retaining, managing, and growing that money,” he noted.

Referencing the Central Bank of Nigeria’s definition of financial literacy, Odiba stated that implementation remains a major national challenge. He said the initiative brings together government agencies, youth groups, academic institutions, and private-sector partners to translate strategy into measurable impact.

The programme’s curriculum covers budgeting, saving, investing, and financial planning — areas where many young people struggle. By offering practical training, real-world insights, and guided mentorship, the initiative aims to build a generation of financially empowered youth capable of driving innovation, entrepreneurship, and sustainable economic growth.

With this partnership, the Federal Government and Investonaire Academy share a common goal: to empower young Nigerians with the financial intelligence and digital tools needed to build wealth, grow businesses, and transform the nation’s economic future.

-

Featured6 years ago

Featured6 years agoLampard Names New Chelsea Manager

-

Featured6 years ago

Featured6 years agoFG To Extends Lockdown In FCT, Lagos Ogun states For 7days

-

Featured6 years ago

Featured6 years agoChildren Custody: Court Adjourns Mike Ezuruonye, Wife’s Case To April 7

-

Featured6 years ago

Featured6 years agoNYSC Dismisses Report Of DG’s Plan To Islamize Benue Orientation Camp

-

Featured4 years ago

Featured4 years agoTransfer Saga: How Mikel Obi Refused to compensate me After I Linked Him Worth $4m Deal In Kuwait SC – Okafor

-

Sports3 years ago

TINUBU LAMBAST DELE MOMODU

-

News11 months ago

News11 months agoZulu to Super Eagles B team, President Tinubu is happy with you

-

Featured6 years ago

Board urges FG to establish one-stop rehabilitation centres in 6 geopolitical zones