Business

Nigeria’s Inflation To Rise, Trump May Reverse Tariffs — Rewane

Cyril Ogar

Economist Bismarck Rewane says the recent increase in the price of petrol may cause a rise in Nigeria’s inflation rate from 23.18%.

“There might be an increase in the rate of inflation because of the increase in the price of petrol but we haven’t seen the corresponding increase in the prices of transport fares so far,” he said on Channels Television’s Business Morning show on Tuesday.

“What we’ve seen in the last few days is that food commodity prices have increased, coupled with the fact that the planting season is here.”

The Managing Director of Financial Derivatives Company Limited said uncertainties and the fears of recession have become very palpable with the imposition of tariffs on imported products to the United States by the Donald Trump presidency.

Rewane said the prices of gold and crude oil have been impacted by the tariff war started by the Trump presidency.

He said, “The United States has disrupted things with its policy initiatives. The United States, I think, will reverse some of those decisions when they begin to impact everybody. We are in a political system. 2026 is going to be mid-term elections and I think the United States is going to begin to retrace some of its steps.”

The economist, however, cautioned against panic, saying the volatility would be for a short while.

Business

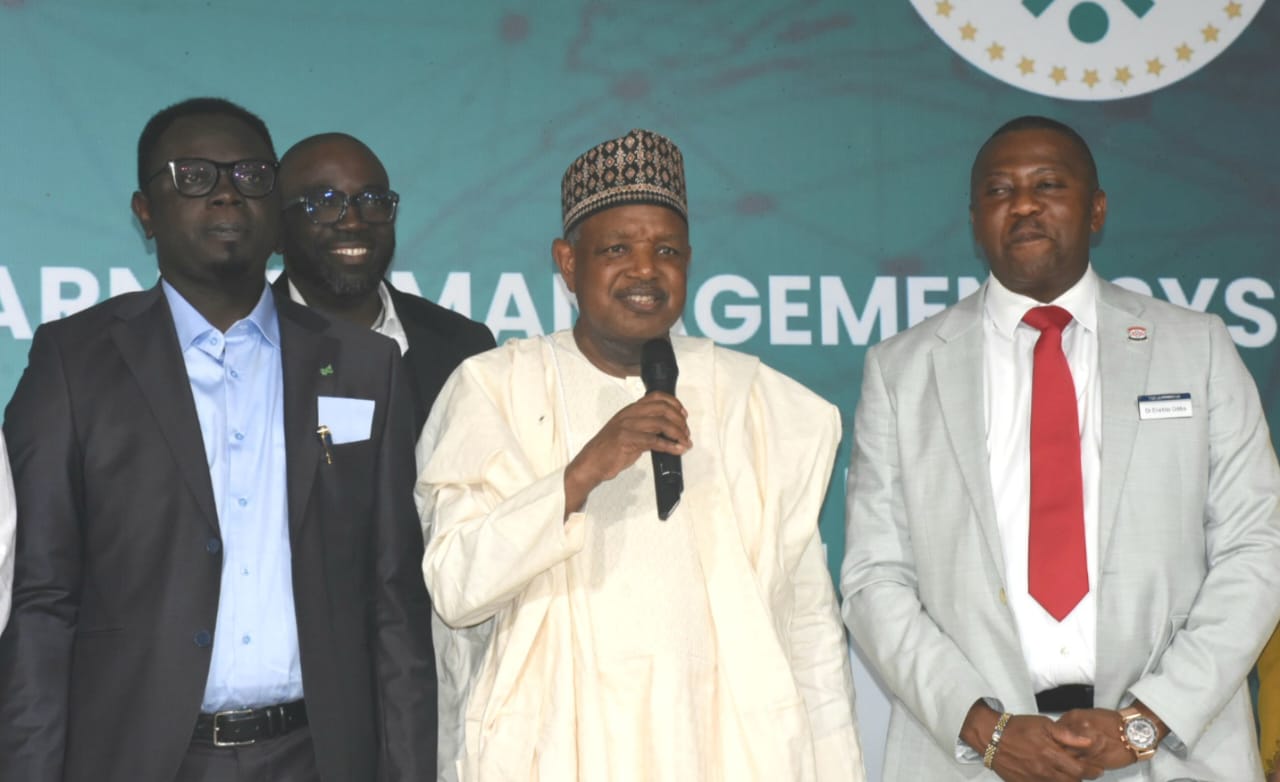

FG, Investonaire Academy Unveil National Programme to Equip 100,000 Youths with Financial Skills, Digital Wealth Tools

By Joel Ajayi

The Federal Government, in collaboration with Investonaire Academy, has unveiled a nationwide financial literacy and wealth-building programme targeting more than 100,000 young Nigerians. The initiative is designed to equip participants with practical skills in budgeting, saving, investing, asset building, and long-term financial planning, positioning them for sustainable prosperity in a rapidly evolving economy.

Launched on Tuesday in Abuja, the Honourable Minister of Youth Development, Comrade Ayodele Olawande, described financial literacy as a necessary survival tool for young people confronting today’s economic realities.

He noted that the initiative represents the foundation of a broader vision expected to extend beyond Nigeria to other African nations and global markets.

Reaffirming the Federal Government’s commitment to supporting over 4,000 corps members annually, the Minister said the programme will provide platforms, resources, and skills needed for both job creation and employability.

“The young people who understand money — how to save, invest, build assets, and manage risk — are the ones who will lead Nigeria into prosperity,” he said.

A major highlight of the launch was the expansion of the Nigeria Youth Academy, a digital platform offering mentorship, training, and startup support. According to the Minister, more than 200 startups will receive empowerment through the Academy’s e-app platform before the end of the year.

He stressed the need for deeper collaboration with private organisations, innovators, and youth-focused groups, noting that government alone cannot drive youth development. He further encouraged young Nigerians to embrace skills acquisition, innovation, and digital enterprise, saying these remain critical to reducing the desire for migration and increasing self-reliance.

Outlining the Ministry’s long-term commitments, Olawande emphasized three priorities: supporting youth innovation, equipping them with growth tools, and safeguarding millions of Nigerian youths under the Ministry’s mandate.

Speaking at the launch, Sebastien Sicre, Chief Operating Officer of Investonaire Academy, said the programme was crafted to revolutionize the way Nigerian youths learn and apply financial knowledge. He highlighted the Academy’s gamified Learning Management System (LMS), which offers interactive learning tools, community forums, and real-time mentorship to make financial education engaging and accessible.

Complementing the digital platform is a new 200-square-metre physical training centre in Abuja, opposite the NNPC Towers, where in-person workshops and mentorship sessions will take place.

The curriculum covers key global asset classes — including equities, commodities, forex, and indices — ensuring participants gain a broad understanding of financial markets.

Sicre added that with Federal Government backing, the programme seeks to unlock new opportunities, strengthen youth participation in the digital economy, and reward outstanding participants through a $1 million funding pool to support new and existing ventures.

International Programme Director of Investonaire Academy, Dr. Enefola Odiba, explained that the initiative aims to bridge long-standing gaps in financial education among Nigerian youths. While schools teach many subjects, he said, essential financial skills are often missing.

“Many people can earn money — earning money can be easy. The real challenge is retaining, managing, and growing that money,” he noted.

Referencing the Central Bank of Nigeria’s definition of financial literacy, Odiba stated that implementation remains a major national challenge. He said the initiative brings together government agencies, youth groups, academic institutions, and private-sector partners to translate strategy into measurable impact.

The programme’s curriculum covers budgeting, saving, investing, and financial planning — areas where many young people struggle. By offering practical training, real-world insights, and guided mentorship, the initiative aims to build a generation of financially empowered youth capable of driving innovation, entrepreneurship, and sustainable economic growth.

With this partnership, the Federal Government and Investonaire Academy share a common goal: to empower young Nigerians with the financial intelligence and digital tools needed to build wealth, grow businesses, and transform the nation’s economic future.

-

Featured6 years ago

Featured6 years agoLampard Names New Chelsea Manager

-

Featured6 years ago

Featured6 years agoFG To Extends Lockdown In FCT, Lagos Ogun states For 7days

-

Featured6 years ago

Featured6 years agoChildren Custody: Court Adjourns Mike Ezuruonye, Wife’s Case To April 7

-

Featured6 years ago

Featured6 years agoNYSC Dismisses Report Of DG’s Plan To Islamize Benue Orientation Camp

-

Featured4 years ago

Featured4 years agoTransfer Saga: How Mikel Obi Refused to compensate me After I Linked Him Worth $4m Deal In Kuwait SC – Okafor

-

Sports3 years ago

TINUBU LAMBAST DELE MOMODU

-

News11 months ago

News11 months agoZulu to Super Eagles B team, President Tinubu is happy with you

-

Featured6 years ago

Board urges FG to establish one-stop rehabilitation centres in 6 geopolitical zones