News

NPC lauds NEDC’ s Positive Impact on Citizen, seeks collaboration

Joel Ajayi

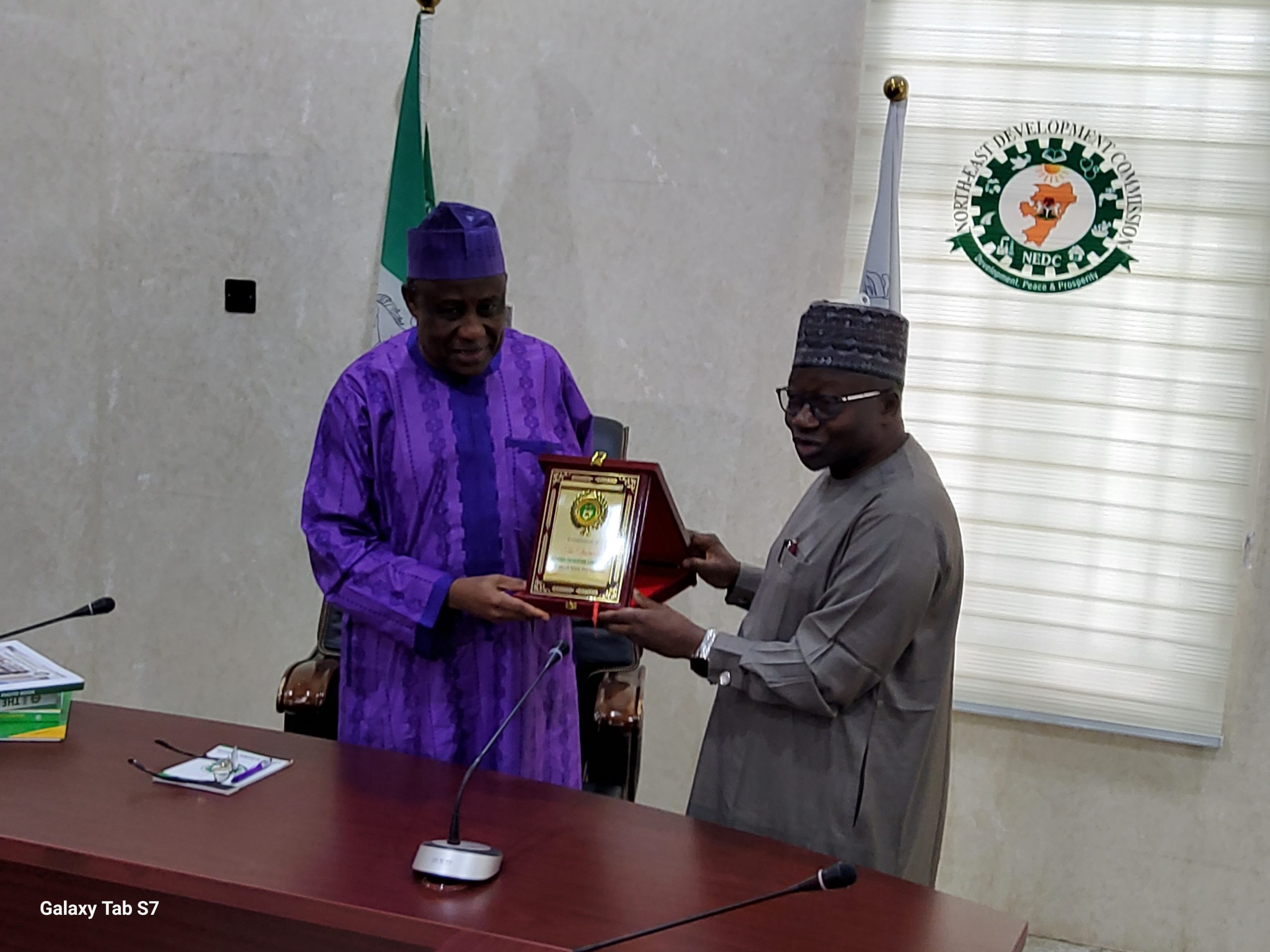

National Population Commission has heaped huge praises on the North East Development Commission NEDC for its countless initiative, innovation and positive impact on the citizen that bring progress, growth and development to the region.

The Chairman of National population Commission Alhaji Issa Kwarra gave this commendation on Monday in Abuja when he led Commission’s management on collaboration visit to NEDC office in Abuja where he reiterates that the Commission is on top of situation to conduct acceptable census in the country.

Kwarra commended the North East Development Commission (NEDC) for addressing the humanitarian issues in the region.

According to him, NEDC has made significant impact on people in the region and we felt that we need to support what you doing for the betterment of the region and Nigeria at large that is why we are here today to appreciate your selfless efforts and positive impact on people and look at area of collaboration.

He stated that the duty of population is not only census, as he highlighted some of the impactful areas of collaborations that will be win-win approach for both sideArea of collaboration which includees; “Conduction of household surveys and socio- economic assessments to gather data on living conditions, health, education, and more.

“To Develop comprehensive geospatial maps of the North East that highlight population density, infrastructure, and resource distribution.

“Use mapping to identify priority areas for intervention, ensuring that NEDC’s efforts are targeted and efficient.

“Provide ongoing support to ensure that the NEDC can effectively utilize demographic data in its operations.

“Provide baseline data that can be used for monitoring and evaluating the impact of NEDC’s projects.

“Address Climate-Related Challenge with Demographic Insight”Speaking shortly after the visit, the Managing Director of NEDC Managing Director/CEO, North East Development Commission NEDC Mohammed Alkali said that the commission is ready to collaborate any agaencies that further put smile on the faces of people of the region.

According to him, think it’s all good to create synergy. You know, we are NEDC and NPC are are all created by the same parent government to support operationally and what government is doing..

“And you know, population is very, very important in any case. And we in the North East Development Commission, we value data very, very high. And as I’ve seen, they are very good source of data.

“So it is very necessarily that we should cooperate, collaborate, so that we have enhanced energy in doing our work, so that we don’t need to waste time and energy looking for data elsewhere, since data is just next door.

“This is why we agree, to meet today, understand ourselves, and create a platform whereby in the future, what you are doing, we are able to sort of between the two of us.

“Though we have planning department and they are doing very well, we also employ external consultant, but sometimes its good to collaborate with the person who has the real data, so that, if you have it, they are out now you can review it, and our team here would analyze for good of the Commission.

“There is no doubt about it, we need data, we need date for all our projects, we need dat for our Mega school, we need dat for IDPs, for flood we need data and is why we are going to sign MOU because in NEDC we dont compromise any that that bring joy to North East we are ready to do it.” He said

News

PSIN Administrator Commends Yobe Government for Championing Leadership Continuity and Institutional Sustainability

Cyril Igele

The Administrator and Chief Executive Officer of the Public Service Institute of Nigeria (PSIN), Barrister Imeh Okon, has applauded the Yobe State Government for its strong commitment to leadership continuity and sustainable governance through strategic investment in human capital development.

Barrister Okon gave the commendation at the opening of a Management Retreat for Yobe State Permanent Secretaries, held at the PSIN headquarters in Abuja.

The retreat, themed “Succession Planning, Leadership Continuity, and Institutional Sustainability in the Yobe State Public Service,” convened senior bureaucrats and resource persons to discuss strategies for strengthening leadership and governance within the state’s civil service.

In her remarks, the PSIN Administrator praised Governor Mai Mala Buni for his foresight and partnership in prioritizing public sector training and capacity development. She described the theme of the retreat as both “timely and visionary,” emphasizing that institutions endure only when leadership is continuous, knowledge is shared, and systems—not individuals—drive performance.

“Institutions thrive not merely on structures or policies, but on the deliberate cultivation of capable leaders who can sustain progress across generations,” she said. “By prioritizing leadership continuity and institutional resilience, Yobe State is leading by example.”

Barrister Okon reiterated PSIN’s mandate to build a competent, ethical, and innovative public service capable of delivering tangible results to citizens. She stressed that effective succession planning must be anchored in continuous training, mentorship, and exposure to emerging governance trends.

Citing best practices from Singapore and the United Kingdom, Okon noted that successful public service systems deliberately identify and nurture potential leaders through structured talent pipelines and transparent career development programmes. According to her, Yobe State’s initiative reflects its readiness to sustain excellence in governance.

She also highlighted PSIN’s flagship programmes—SMART-P, which builds administrative and technical capacity; LEAD-P, designed to groom emerging leaders; and the Exit from Service Masterclass, which prepares officers for life after service. Okon urged the Yobe Government to adopt the Exit Masterclass into its human resource framework to ensure a smooth transition for retirees, preserve institutional knowledge, and promote productivity through entrepreneurship and consultancy.

“Succession planning is not an event but a culture that must be institutionalised at every level of public administration,” she added. “When we prepare successors in advance and invest in continuous learning, we guarantee the sustainability of reforms and consistency in governance.”

Declaring the retreat open, the Acting Head of Service of Yobe State, Alhaji Abdullahi Shehu, reaffirmed Governor Buni’s commitment to building a results-driven and high-performing public service.

Represented by the Permanent Secretary, Public Service, Alhaji Shehu, the Acting Head of Service expressed gratitude to God and lauded PSIN as the “mother institution of public service learning.” He stated that Governor Buni has consistently directed the Office of the Head of Service to promote seamless succession planning and capacity building to enhance efficiency and accountability across government institutions.

“In line with this directive, we have brought the top echelon of the state civil service to PSIN—being the drivers and core implementers of government policies and programmes—to strengthen continuity and sustainability in our reforms,” he said.

He urged participants to fully engage in the retreat, share experiences, and cascade the knowledge gained to officers across ministries, departments, and agencies. The exercise, he explained, forms part of a deliberate strategy to institutionalize effective succession planning within the Yobe State Civil Service, thereby ensuring sustained productivity and improved service delivery to citizens.

-

Featured6 years ago

Featured6 years agoLampard Names New Chelsea Manager

-

Featured6 years ago

Featured6 years agoFG To Extends Lockdown In FCT, Lagos Ogun states For 7days

-

Featured6 years ago

Featured6 years agoChildren Custody: Court Adjourns Mike Ezuruonye, Wife’s Case To April 7

-

Featured6 years ago

Featured6 years agoNYSC Dismisses Report Of DG’s Plan To Islamize Benue Orientation Camp

-

Featured4 years ago

Featured4 years agoTransfer Saga: How Mikel Obi Refused to compensate me After I Linked Him Worth $4m Deal In Kuwait SC – Okafor

-

Sports3 years ago

TINUBU LAMBAST DELE MOMODU

-

News10 months ago

News10 months agoZulu to Super Eagles B team, President Tinubu is happy with you

-

Featured6 years ago

Board urges FG to establish one-stop rehabilitation centres in 6 geopolitical zones