Business

RMAFC Mediates between Anambra Communities and Oil Exploration Company

Joel Ajayi

As part of its oversight functions, the Revenue Mobilization Allocation and Fiscal Commission (RMAFC), through its Investment Monitoring Committee, convened a high-level engagement to mediate between the Sterling Oil Exploration & Energy Production Company (SEEPCO) and the host communities in Ogbaru Local Government Area of Anambra State.

Speaking during the engagement which took place today at the Commission’s Boardroom at the headquarters in Abuja, Hon. Ekene Enefe disclosed that the Committee called for the hearing because there were so many outstanding issues that needed to be thrashed out between the Company and the host Communities following some complaints that SEEPCO was not living up to its corporate social responsibility.

He emphasized the need to resolve the issues as they have direct revenue implications for the Federation. He said, if operations take place in a stable, inclusive, and conducive host community environment, the nation could be sure of higher, safer and predictable revenue generation.

The Hon. Commissioner asked the representative of SEEPCO Mr. Rajender Bhangara qestions on whether the Company had properly established a Host Community Development Trust as required under the Petroleum Industry Act; made the required contribution from its qualifying expenditure and how those funds were being applied to infrastructure and environmental remediation.

He also enquired whether SEEPCO had conducted a needs assessment of the affected communities. He further requested information on gas flaring in the Ogbaru axis and evidence of flare penalty payments to government and compensation to the Communitues. He requested to know the metering systems used to determine flared volumes.

Hon. Enefe also queried the status of pipelines and wondered why the product was being evacuated from Anambra to Delta State without a local flow station or farm tank. He also wanted the company to reveal the proportion of the stream of gas versus crude and the extent of their commitment in terms of payment made to the communities under the existing MoUs.

He added that the Committee expected full disclosure on scholarships awarded, indigene employment—especially full‑time, skilled workers—and visible infrastructure delivered in the communities hosting their operations.

A member of the Investment Committee and Honourable Commissioner representing Delta State in the Commissio, Barr. Mathew Aruviere Egharhevwa emphasized the need for the representatives of SEEPCO to provide the database detailing the quantity of gas exploration and what had been embarked on in terms of human capital and infrastructural development.

In their contributions, the community representatives welcomed the intervention, adding that they desired to have a peaceful and harmonious relationship with the company built upon fairness and accountability.

Mr. Esumai Patrick Chukwudi, who represented the Ogwu Ikpele community, said. “What we want is fairness and a sense of belonging; our people need to see real development—water, health, access roads , jobs—not just promises,”

In his contribution, Hon. Vitalis Ekweanua of Ogwu Aniocha stressed that the communities came to Abuja because of their belief in dialogue and desire to have a robust relationship that would serve the interest of everyone. He said, “We are not against operations; we are partners in progress, but host communities must see benefits where resources are taken.”

Responding, SEEPCO’s Head of Business Development, Mr. Rajender Bhangara, thanked the Commission for providing the platform for the discussion, saying “we value this dialogue and the concerns raised; we have taken detailed notes and will return with our technical community, and operations teams to respond comprehensively.”

He said the company’s operations within OML 143 link Anambra field locations to existing infrastructure in Delta state as well as all produced volumes of oil and gas are monitored and accounted for through established metering and evacuation systems. He assured the gathering that the company would share the records, including gas flare and environmental compliance data, with the Commission.

Mr. Bhangara then requested another date to enable the company to sufficiently provide the required information regarding their operations.

Parties agreed to continue engagement under the facilitation of RMAFC and to reconvene with full technical and community relations teams to address the issues raised.

Business

FG, Investonaire Academy Unveil National Programme to Equip 100,000 Youths with Financial Skills, Digital Wealth Tools

By Joel Ajayi

The Federal Government, in collaboration with Investonaire Academy, has unveiled a nationwide financial literacy and wealth-building programme targeting more than 100,000 young Nigerians. The initiative is designed to equip participants with practical skills in budgeting, saving, investing, asset building, and long-term financial planning, positioning them for sustainable prosperity in a rapidly evolving economy.

Launched on Tuesday in Abuja, the Honourable Minister of Youth Development, Comrade Ayodele Olawande, described financial literacy as a necessary survival tool for young people confronting today’s economic realities.

He noted that the initiative represents the foundation of a broader vision expected to extend beyond Nigeria to other African nations and global markets.

Reaffirming the Federal Government’s commitment to supporting over 4,000 corps members annually, the Minister said the programme will provide platforms, resources, and skills needed for both job creation and employability.

“The young people who understand money — how to save, invest, build assets, and manage risk — are the ones who will lead Nigeria into prosperity,” he said.

A major highlight of the launch was the expansion of the Nigeria Youth Academy, a digital platform offering mentorship, training, and startup support. According to the Minister, more than 200 startups will receive empowerment through the Academy’s e-app platform before the end of the year.

He stressed the need for deeper collaboration with private organisations, innovators, and youth-focused groups, noting that government alone cannot drive youth development. He further encouraged young Nigerians to embrace skills acquisition, innovation, and digital enterprise, saying these remain critical to reducing the desire for migration and increasing self-reliance.

Outlining the Ministry’s long-term commitments, Olawande emphasized three priorities: supporting youth innovation, equipping them with growth tools, and safeguarding millions of Nigerian youths under the Ministry’s mandate.

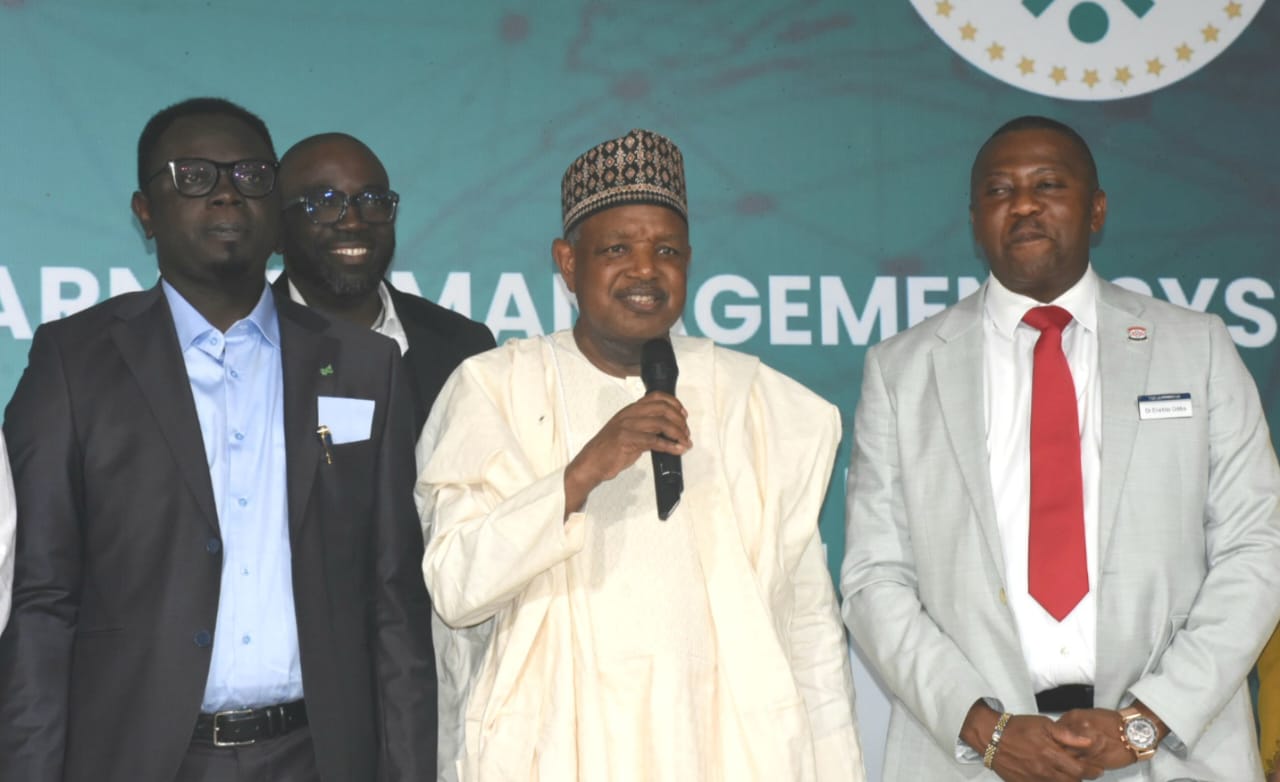

Speaking at the launch, Sebastien Sicre, Chief Operating Officer of Investonaire Academy, said the programme was crafted to revolutionize the way Nigerian youths learn and apply financial knowledge. He highlighted the Academy’s gamified Learning Management System (LMS), which offers interactive learning tools, community forums, and real-time mentorship to make financial education engaging and accessible.

Complementing the digital platform is a new 200-square-metre physical training centre in Abuja, opposite the NNPC Towers, where in-person workshops and mentorship sessions will take place.

The curriculum covers key global asset classes — including equities, commodities, forex, and indices — ensuring participants gain a broad understanding of financial markets.

Sicre added that with Federal Government backing, the programme seeks to unlock new opportunities, strengthen youth participation in the digital economy, and reward outstanding participants through a $1 million funding pool to support new and existing ventures.

International Programme Director of Investonaire Academy, Dr. Enefola Odiba, explained that the initiative aims to bridge long-standing gaps in financial education among Nigerian youths. While schools teach many subjects, he said, essential financial skills are often missing.

“Many people can earn money — earning money can be easy. The real challenge is retaining, managing, and growing that money,” he noted.

Referencing the Central Bank of Nigeria’s definition of financial literacy, Odiba stated that implementation remains a major national challenge. He said the initiative brings together government agencies, youth groups, academic institutions, and private-sector partners to translate strategy into measurable impact.

The programme’s curriculum covers budgeting, saving, investing, and financial planning — areas where many young people struggle. By offering practical training, real-world insights, and guided mentorship, the initiative aims to build a generation of financially empowered youth capable of driving innovation, entrepreneurship, and sustainable economic growth.

With this partnership, the Federal Government and Investonaire Academy share a common goal: to empower young Nigerians with the financial intelligence and digital tools needed to build wealth, grow businesses, and transform the nation’s economic future.

-

Featured6 years ago

Featured6 years agoLampard Names New Chelsea Manager

-

Featured6 years ago

Featured6 years agoFG To Extends Lockdown In FCT, Lagos Ogun states For 7days

-

Featured6 years ago

Featured6 years agoChildren Custody: Court Adjourns Mike Ezuruonye, Wife’s Case To April 7

-

Featured6 years ago

Featured6 years agoNYSC Dismisses Report Of DG’s Plan To Islamize Benue Orientation Camp

-

Featured4 years ago

Featured4 years agoTransfer Saga: How Mikel Obi Refused to compensate me After I Linked Him Worth $4m Deal In Kuwait SC – Okafor

-

Sports3 years ago

TINUBU LAMBAST DELE MOMODU

-

News11 months ago

News11 months agoZulu to Super Eagles B team, President Tinubu is happy with you

-

Featured6 years ago

Board urges FG to establish one-stop rehabilitation centres in 6 geopolitical zones