Featured

Sunday Akin Dare’s Appointment: A Round Peg In A Round Hole

By Joel Ajayi

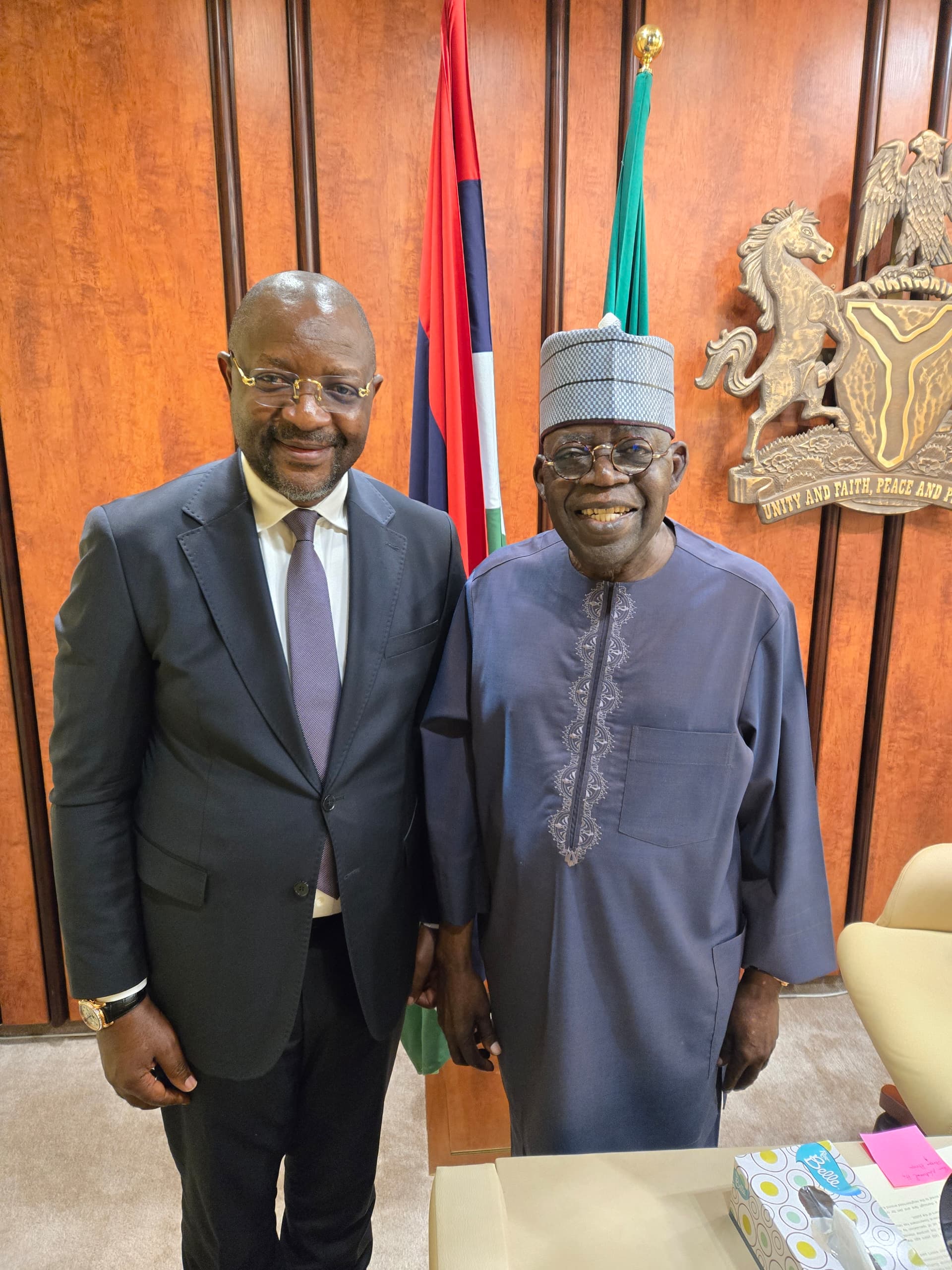

The recent appointment of former Minister of Youth and Sports Development, Sunday Akin Dare, as the new Presidential Adviser on Public Communication and Orientation, is a move that deserves widespread commendation.

In a significant departure from previous practices, this strategic choice reflects a pragmatic approach to national development, reaffirming President Bola Ahmed Tinubu’s commitment to excellence and impactful governance.

This appointment symbolizes the President’s dedication to assembling a team of competent, committed, and qualified individuals who are positioned to contribute meaningfully to the administration.

For those familiar with Dare’s career, politics, and achievements, it is clear that he is indeed a “round peg in a round hole” for this new role.

Sunday Dare brings a wealth of expertise as a seasoned media professional and a visionary leader. As the President’s special adviser, he is expected to leverage his extensive background in communications to effect positive change in Nigeria’s public communication landscape.

With over three decades of experience in journalism, Dare has made significant contributions to media and communications both locally and globally.

His journey began with publications such as *The Nation* magazine in New York and *Fourth Estate* magazine during Nigeria’s military era, where he became part of a group of courageous “guerrilla journalists” who risked their lives to oppose military dictatorship.

Dare’s career expanded internationally when he served as the Chief of the Hausa Service, African Division at Voice of America in Washington, DC. In this role, he led a team of journalists across seven African countries, showcasing his expertise in media management and his capacity to oversee complex operations effectively. His media management acumen was further evident during his role as Senior Special Assistant (Media) to the Minister of Information and Communications under President Yar’Adua, where he influenced public information policies significantly.

Additionally, Dare was instrumental in shaping Nigeria’s media landscape through strategic moves, including his key role in the 2014 sale of the 2.3 GHz spectrum frequency, which marked a pivotal shift in media convergence.

His dedication to promoting media excellence extends beyond government; as the founder of the Social Media Clinic, he championed digital literacy, highlighting his forward-thinking approach to harnessing technology for societal development.

Dare’s distinguished career also saw him as the Executive Commissioner for Stakeholder Management at the Nigerian Communications Commission (NCC), where he was renowned for effectively navigating stakeholder relationships and driving strategic communication initiatives.

His contributions have been acknowledged with numerous accolades, including the Voice of America Meritorious Honor Award and the Reuters Foundation Journalism Research Fellowship.

Holding a Bachelor of Science in International Studies, a Master of Arts in Law and Diplomacy, and experiences from institutions like New York University, Harvard, and Oxford, Dare’s academic and professional credentials are noteworthy. He is a recipient of the national honor of Commander of the Order of the Niger (CON), further underscoring his dedication to national service.

Dare’s appointment is a testament to the vision of a government committed to elevating the standards of public communication and orientation in Nigeria.

As he steps into this role, Nigerians can expect to witness impactful communication initiatives that reflect both the President’s and Dare’s dedication to national progress.

Featured

NELFUND: The Renewed Hope Engine Propelling Nigeria’s Youth into Tomorrow

By Dayo Israel, National Youth Leader, APC

As the National Youth Leader of the All Progressives Congress, I have spent most of my tenure fighting for a Nigeria where every young person, regardless of their ward or local government, family income, or circumstance, can chase dreams without the chains of financial despair.

Today, that fight feels like victory, thanks to the Nigerian Education Loan Fund (NELFUND). Launched as a cornerstone of President Bola Ahmed Tinubu’s Renewed Hope Agenda, this initiative isn’t just a policy tweak; it’s a revolution. And under the steady, visionary hand of Managing Director Akintunde Sawyerr, NELFUND has transformed from a bold promise into a roaring engine of opportunity, disbursing over ₦116 billion to more than 396,000 students and shattering barriers for over a million applicants.

Let’s be clear: NELFUND was always destined to be a game-changer. Signed into law by President Tinubu on April 3, 2024, it repealed the outdated 2023 Student Loan Act, replacing it with a modern, inclusive framework that covers tuition, upkeep allowances, and even vocational training—ensuring no Nigerian youth is left on the sidelines of progress.

But what elevates it from groundbreaking to generational? Leadership. Enter Akintunde Sawyerr, the diplomat-turned-executioner whose career reads like a blueprint for results-driven governance. From co-founding the Agricultural Fresh Produce Growers and Exporters Association of Nigeria (AFGEAN) in 2012—backed by icons like former President Olusegun Obasanjo and Dr. Akinwumi Adesina—to steering global logistics at DHL across 21 countries, Sawyerr brings a rare alchemy: strategic foresight fused with unyielding accountability.

As NELFUND’s pioneer MD, he’s turned a fledgling fund into a finely tuned machine, processing over 1 million applications since May 2024 and disbursing ₦116 billion—₦61.33 billion in institutional fees and ₦46.35 billion in upkeep—to students in 231 tertiary institutions nationwide. That’s not bureaucracy; that’s brilliance.

Sawyerr’s touch is everywhere in NELFUND’s ascent. Since the portal’s launch, he’s overseen a digital ecosystem that’s as transparent as it is efficient—seamless verification, BVN-linked tracking, and real-time dashboards that have quashed misinformation and built trust. In just 18 months, the fund has empowered 396,252 students with interest-free loans, many first-generation learners who might otherwise have dropped out.

Sensitization drives in places like Ekiti and Ogun have spiked applications — 12,000 in a single day in one instance, while expansions to vocational centers in Enugu pilot the next wave of skills-based funding. And amid challenges like data mismatches and fee hikes, Sawyerr’s team has iterated relentlessly: aligning disbursements with academic calendars, resuming backlogged upkeep payments for over 3,600 students, and even probing institutional compliance to safeguard every kobo. This isn’t management; it’s mastery—a man who doesn’t just lead but launches futures.

Yet, none of this happens in a vacuum. President Tinubu’s alliance with trailblazers like Sawyerr is the secret sauce securing Nigeria’s tomorrow. The President’s Renewed Hope Agenda isn’t rhetoric; it’s resources—₦100 billion seed capital channeled into a system that prioritizes equity over elitism. Together, they’ve forged a partnership where vision meets velocity: Tinubu’s bold repeal of barriers meets Sawyerr’s boots-on-the-ground execution, turning abstract policy into tangible triumphs. It’s a synergy that’s non-discriminatory by design—Christians, Muslims, every tribe and tongue united in access—fostering national cohesion through classrooms, not courtrooms.

As Sawyerr himself notes, this is “visionary leadership” in action, where the President’s political will ignites reforms that ripple across generations.

Why does this matter to us, Nigeria’s youth? Because NELFUND isn’t handing out handouts—it’s handing out horizons. In a country where 53% of us grapple with unemployment, these loans aren’t just funds; they’re fuel for innovation, entrepreneurship, and endurance.

Picture it: A first-generation polytechnic student in Maiduguri, once sidelined by fees, now graduates debt-free (repayments start two years post-NYSC, employer-deducted for ease) and launches a tech startup. Or a vocational trainee in Enugu, equipped with skills funding, revolutionizing local agriculture. This is quality education that endures—not fleeting certificates, but lifelong launchpads. Sawyerr’s focus on human-centered design ensures loans cover not just books, but bread—upkeep stipends of ₦20,000 monthly keeping hunger at bay so minds can soar. Under his watch, NELFUND has debunked doubts, refuted fraud claims, and delivered results that scream sustainability: Over ₦99.5 billion to 510,000 students by September, with 228 institutions on board.

As youth leaders, we see NELFUND for what it is: A covenant with our future. President Tinubu and MD Sawyerr aren’t just allies; they’re architects of an educated, empowered Nigeria—one where poverty’s grip loosens with every approved application, and innovation blooms from every funded desk. This isn’t charity; it’s an investment in the 70 million of us who will lead tomorrow.

We’ve crossed one million applications not because of luck, but leadership—a duo that’s turning “access denied” into “future unlocked.”

To President Tinubu: Thank you for daring to dream big and backing it with action.

To Akintunde Sawyerr: You’re the executor we needed, proving that one steady hand can steady a nation.

And to every Nigerian youth: Apply. Graduate. Conquer.

Because with NELFUND, your generation isn’t just surviving—it’s thriving, enduring, and eternal.

The Renewed Hope isn’t a slogan; it’s our story, now written in scholarships and success. Let’s keep turning the page.

Dayo Israel is the National Youth Leader of the All Progressives Congress (APC).

-

Featured6 years ago

Featured6 years agoLampard Names New Chelsea Manager

-

Featured6 years ago

Featured6 years agoFG To Extends Lockdown In FCT, Lagos Ogun states For 7days

-

Featured6 years ago

Featured6 years agoChildren Custody: Court Adjourns Mike Ezuruonye, Wife’s Case To April 7

-

Featured6 years ago

Featured6 years agoNYSC Dismisses Report Of DG’s Plan To Islamize Benue Orientation Camp

-

Featured4 years ago

Featured4 years agoTransfer Saga: How Mikel Obi Refused to compensate me After I Linked Him Worth $4m Deal In Kuwait SC – Okafor

-

Sports3 years ago

TINUBU LAMBAST DELE MOMODU

-

News11 months ago

News11 months agoZulu to Super Eagles B team, President Tinubu is happy with you

-

Featured6 years ago

Board urges FG to establish one-stop rehabilitation centres in 6 geopolitical zones