Business

TAJBank Charts Roadmap For future Growth At 3rd AGM

…Eyes National Bank Licence

Joel Ajayi

Smarting from the impressive financial and other operational performance indices recorded since it debuted as a non-interest bank in Nigeria two years ago, the Board and Management of TAJBank Limited on Wednesday highlighted indices to ensure its continuous and sustainable growth in the years ahead.

The Managing Director/CEO of the bank, Mr. Hamid Joda, in his report at the bank’s 2022 Annual General Meeting (AGM) held in Abuja, attributed the performances of the non-interest lender over the past two years to innovativeness in key areas of customer-centric service delivery powered by world-class technologies and solutions, human resource capacity building and shareholders and customers’ growing confidence.

Specifically, the seasoned banker listed the key objectives considered crucial to transforming TAJBank into an industry leader in the years ahead as including, securing a license to make TAJBank a national bank by the second quarter of 2022; and promoting financial inclusion by leveraging various channels and touch points, especially through the bank’s electronic platforms.

In addition, Joda told the shareholders that one of their objectives was to make TAJBank to “be recognized as the market leader in the non-interest industry in Nigeria” and that another major strategy is to “expand its branch network across state capitals/major commercial centers in Nigeria to offer non-interest banking product and services to the understand markets.”

L-R: Managing Director/CEO TAJBank Limited. Mr. Hamid Joda; the Board Chairman, Alhaji Tanko Isiaku Gwamma; Acting Company Secretary, Hajia Amina Usman Toli; and Executive Director, Mr. Sheriff Idi; during the bank’s 3rd Annual General Meeting (AGM) held in Abuja yesterday

He also spoke on plans to grow the bank’s agency network to 100,000 agents by 2025 thereby reducing the financial exclusion rate; and to transform TAJBank into a leading digital bank in the country before the end of this year.

He expantiated: “Our success in 2021 demonstrates that we not only kept our commitment to our stakeholders, but we are growing in a sustainable manner so that we can continue to enhance value to society while also generating the revenue our shareholders will appreciate.

“We are constantly improving our operations so that we can respond to our clients’ ever-changing needs in their daily lives more efficiently and effectively. We are also pushing ourselves further beyond our comfort zones to provide a viable financial platform for all our stakeholders”, Joda added.

Earlier in his statement, the bank’s Chairman, Alhaji Tanko Gwamma, reported that TAJBank attracted and retained more customers, and recorded exponential growth in its risk asset base, while it is committed to achieving the required regulatory metrics, as well as pursuing strong growth in its balance sheet items, amongst other positive indices.

He enthused: “I am delighted to inform you that the future of the Bank is outstandingly bright and beautiful. We are confident to state that our exceptional service delivery, robust technological deployment, and responsive operational system yielded the excellent performance we have recorded so far.”

Business

Edun Commends Outgoing World Bank County Director Dr Chaudhary, Lauds Organization’s impact On Nigeria’s Economy

Joel Ajayi no

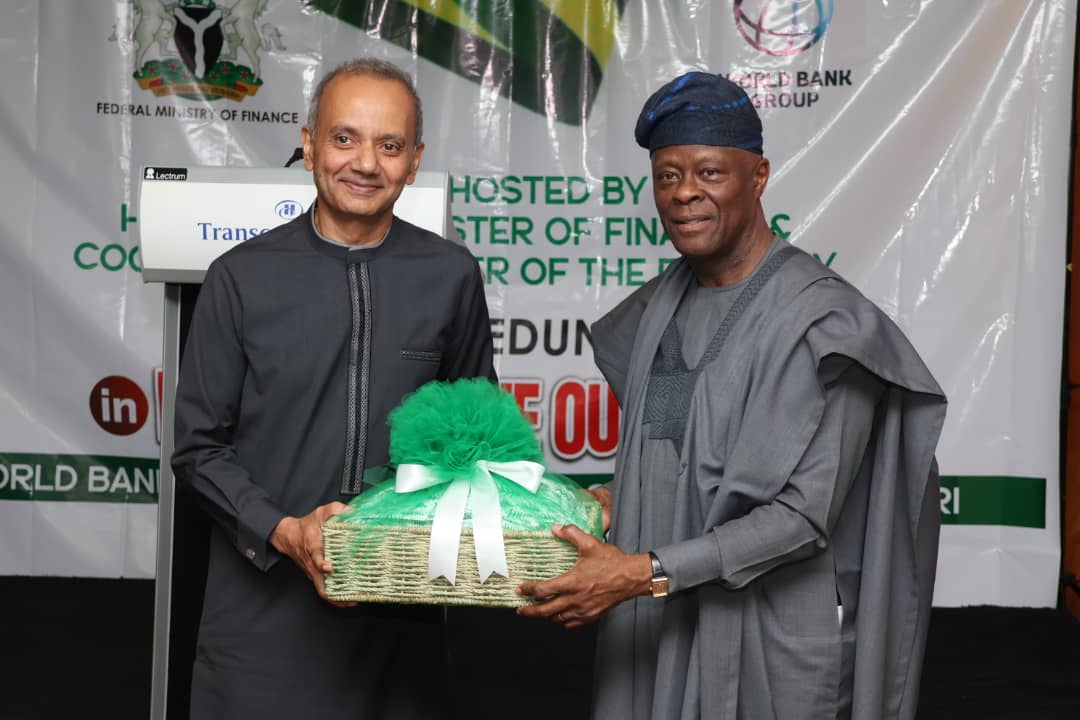

The Honourable Minister of Finance and Co-ordinating Minister of the Economy, Mr Wale Edun, has commended the outgoing World Bank Country Director, Dr. Shubham Chaudhari for his Significant Contributions to Nigeria’s Economic Growth.

At an event held in Abuja, hosted by the Honourable Minister in honour of the out-going World Bank Country Director, Mr Edun acknowledged the Organization’s crucial role in promoting socio-economic sustainability and enhancing Nigeria’s economic competitiveness.

He expressed appreciation for the remarkable achievements recorded during Dr. Chaudhari’s tenure and reaffirmed the country’s commitment to building on these accomplishments so as to further drive economic progress in line with the Renewed Hope Agenda of the President Bola Ahmed Tinubu-led Administration.

*We appreciate your tireless efforts towards the promotion of economic growth and development in Nigeria. Your leadership and expertise have made a significant impact on our country’s progress. Your dedication to supporting Nigeria’s development agenda is truly commendable.

“We are grateful for these contributions and look forward to continued collaboration. Your commitment to fostering inclusive and sustainable growth in Nigeria is inspiring. We appreciate your partnership and guidance in shaping our country’s future*, Edun said.

He informed that the hallmark of the present administration’s policy thrust that brought fiscal reforms was aimed at boosting the nation’s economic development with a view to attracting foreign investments so as to ensure job creation, poverty reduction and improved standard of living for the citizenry.

The Minister assured that Nigeria offers a wealth of opportunities for foreign investors, with a large and growing market, rich natural resources, and a skilled workforce. *We invite you to explore the possibilities and partner with us for mutual growth. Join us in harnessing the potential of Nigeria’s emerging economy. Our country offers a favourable business environment, investment incentives, and a dynamic market waiting to be tapped.

Mr Wale Edun invited the international community to discover the opportunities and advantages of investing in Nigeria.

“Our government is committed to creating a conducive environment for businesses to thrive and succeed. We are inviting the international development partners to come to Nigeria and invest their resources. Nigeria is a country with diverse business opportunities and market potentials for profit maximisation”, he stressed.

The Minister stated further that Nigeria would continue to be a development partner with the World Bank, and that the present administration was committed to championing a good cause as well as implement policies that would boost the country’s economy in order to make it more vibrant and resilient.

Edun further appreciated Dr Chaudhari’s tenure, which he said, underscores the importance of supporting and recognizing Nigeria, aligning with President Bola Ahmed Tinubu’s pragmatic leadership in providing good governance.

He added that the reforms initiated by the administration would serve as a window to the global investment community, stressing that Nigeria is open for business with stable and profitable benefits thereby calling on Philanthropists, both within and outside the country, to invest their resources in Nigeria, a country which he said, has the largest population in Africa.

Edun explained that *the disputable access to renewal energy recently launched was an indication to build trust, attract foreign investment, and foster international partnerships aimed at reinvigorating the Nigerian economy.”

Speaking during the event, Dr. Shaubham Chaudhari, the out-going World Bank Country Director, described the event as symbolic and strategic, saying that it would help build bonds in relationship trust. He commended Nigeria for its proactive measures and robust efforts in bracing up monetary policies and in fostering sustainable economic development despite the daunting challenges.

The out-going Director assured that his Organisation’s doors were widely open for more collaborations and partnerships for the country’s growth.

Earlier in her remarks at the event, the Permanent Secretary, Federal Ministry of Finance, Mrs Lydia Shehu Jafiya assured that the Ministry will continue to provide an enabling environment for the full implementation of the policies, programmes and projects of the Federal Government in line with its mandate.

She appealed to the international community to support the efforts of the present administration in its determination to boost the country’s economy and further stressed the need for international partners to take advantage of the country’s diversity and invest their resources for maximum benefits.

*Nigeria offers a vast and untapped market, rich in natural resources and human capital. We invite you to explore the numerous investment opportunities and be a part of our growth story. Join us in shaping Nigeria’s future and tapping into the immense potentials of our economy. Together, let’s create a prosperous and sustainable tomorrow.**Nigeria is open for business. We welcome foreign investors to partner with us in unlocking our economic potentials and driving growth in key sectors.” Jafiya said.

Also speaking, the Permanent Secretary Special Duties, Mr Okokon Ekanem Udo, assured that the present administration was committed to putting and implementing projects that will impact on the lives of Nigerians in line with contemporary global realities.

He commended the outgoing World Bank Country Director, Dr. Shaubham Chaudhari for his commitment and dedication.

Thank you for your dedication and commitment. We are grateful for your unwavering support and guidance, which has helped us navigate complex development challenges and create a brighter future for Nigerians.* Udo said.

-

Featured5 years ago

Featured5 years agoLampard Names New Chelsea Manager

-

Featured4 years ago

Featured4 years agoFG To Extends Lockdown In FCT, Lagos Ogun states For 7days

-

Featured5 years ago

Featured5 years agoNYSC Dismisses Report Of DG’s Plan To Islamize Benue Orientation Camp

-

Featured4 years ago

Featured4 years agoChildren Custody: Court Adjourns Mike Ezuruonye, Wife’s Case To April 7

-

Featured3 years ago

Featured3 years agoTransfer Saga: How Mikel Obi Refused to compensate me After I Linked Him Worth $4m Deal In Kuwait SC – Okafor

-

Sports2 years ago

TINUBU LAMBAST DELE MOMODU

-

News9 months ago

News9 months agoJubilation In Kaduna As Tribunal Upholds Ekene Adam Winner Of Reps Election

-

Featured5 years ago

Board urges FG to establish one-stop rehabilitation centres in 6 geopolitical zones